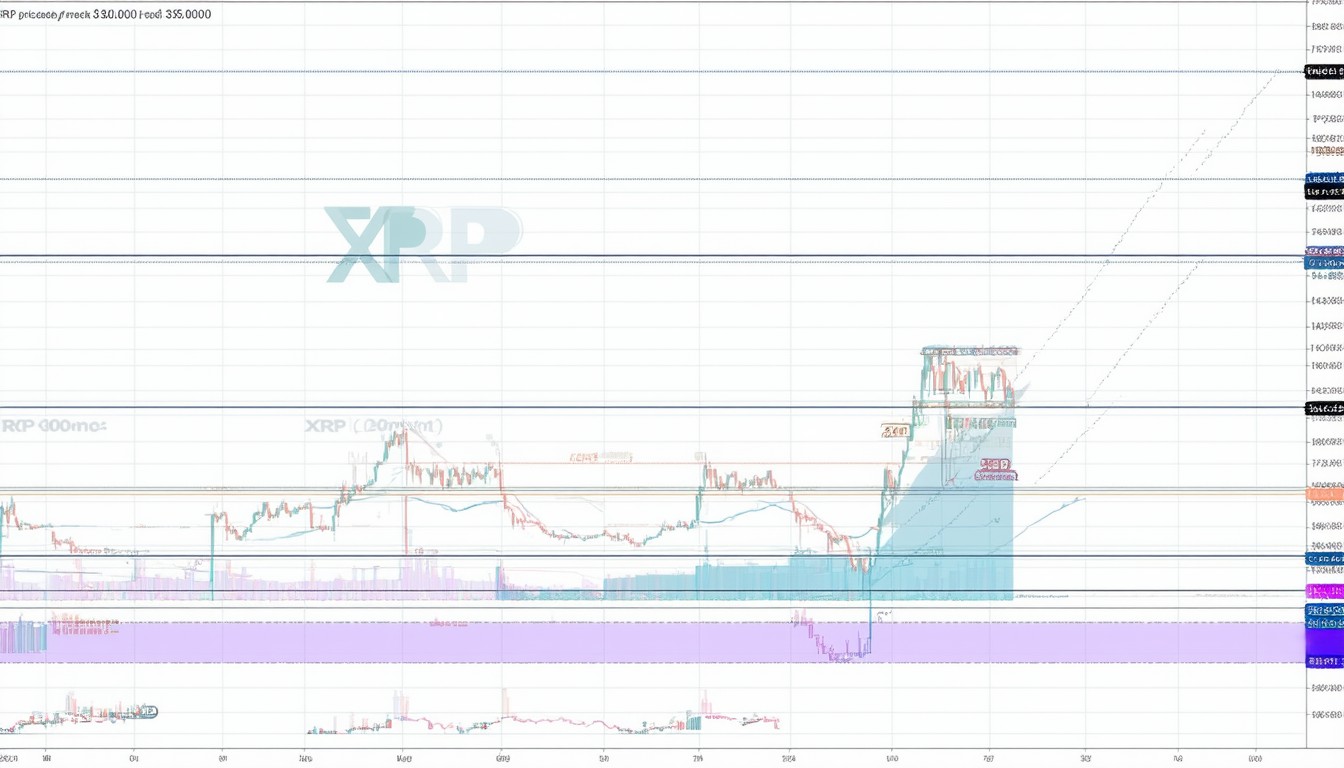

Introduction: The XRP Price Prediction Debate

The question of whether XRP could ever soar to $10,000 or even $35,000 per coin is a source of enduring fascination—and debate—among cryptocurrency investors. For those holding XRP or considering an entry point, this price prediction isn’t just academic. It speaks directly to dreams of outsized returns or concerns about market exuberance outpacing reality. In this article, we’ll critically examine the factors influencing such ambitious price targets, assess the core frameworks that underpin these forecasts, and offer practical steps for navigating XRP’s uncertain future.

What “XRP $10,000 to $35,000” Means for Crypto Investors

At its core, the phrase “XRP $10,000 to $35,000” encapsulates wild speculation, bold optimism, and real questions about utility and adoption. XRP, the digital asset developed by Ripple Labs, was designed primarily as a bridge currency to facilitate rapid, low-cost international payments. Its market price, however, is driven by speculation as much as by use case and institutional acceptance.

Why This Matters for Prospective and Current Investors

For anyone invested in, or considering, XRP, understanding these lofty price predictions is crucial. The stakes are clear: at today’s prices (under $1 as of 2024), the returns implied by a rise to $10,000 or $35,000 are astronomical. However, such gains would require unimaginable shifts in demand, technology adoption, and perhaps the entire structure of the global financial system. Knowing how to interpret, question, and act on such forecasts is essential for making informed decisions and avoiding costly mistakes.

Core Framework: How (and Whether) XRP Could Reach Such Highs

Predicting any cryptocurrency’s long-term price requires considering supply limits, demand sources, regulatory outlook, competition, and technology. For XRP, several pillars frame the debate:

1. Market Capitalization and Supply Mathematics

With a fixed maximum supply of 100 billion XRP, a price of $10,000 per XRP would imply a market cap close to $1 quadrillion—over ten times the value of all global assets (Statista, 2023). For $35,000, the numbers become even less tenable. Rational investors must consider whether this aligns with economic reality or represents sheer hype.

2. Real-World Utility and Institutional Adoption

XRP aims to function as a bridge asset in cross-border payments. While Ripple Labs has made traction with some banks and financial institutions, global adoption as a universal settlement tool remains limited. Without systemic, worldwide usage, sustained demand appears unlikely to support even a fraction of these high price points.

3. Regulatory Resolution and Clarity

XRP’s status as a security or currency remains under scrutiny, especially in major markets like the United States. The resolution of ongoing litigation and clear, favorable regulation are prerequisites for institutional adoption on the scale that might drive extraordinary price appreciation.

4. Competing Technologies and Alternatives

The financial technology landscape is crowded. Central Bank Digital Currencies (CBDCs), stablecoins, and other blockchain-based solutions all compete in the payment space. If these alternatives become adopted more widely, the pool of potential demand for XRP could shrink instead of grow.

Tools, Checks, and Metrics to Monitor

- On-Chain Data: Monitor transaction volume, wallet distribution, and active addresses for real-time utility insights.

- Partnership Announcements: Track substantive deals with financial institutions or payment systems, not just speculative news.

- Regulatory News: Stay abreast of SEC actions, global policy shifts, and legal outcomes affecting Ripple and XRP holders.

- Market Cap Comparisons: Contextualize price movement against global payment volumes and other major assets.

Data & Proof: Market Realities Versus Aspirational Forecasts

Key Statistics

- The current circulating supply of XRP is about 54 billion coins (Ripple, 2023).

- XRP’s all-time high price was $3.84 in 2018 (CoinMarketCap, 2023).

- The total value of daily global cross-border payments is estimated at $150 trillion annually, a fraction of which is currently settled using cryptocurrencies (SWIFT, 2023).

- As of 2023, over 75% of global banks are experimenting with blockchain for payments, but less than 2% use XRP or Ripple solutions (Deloitte, 2023).

What These Numbers Mean for Investors

The gap between XRP’s current adoption and price, and the astronomical numbers proposed in these predictions, is clear. The implied market cap at $10,000 or $35,000 per XRP far exceeds both the asset’s intended function and the combined value of global payment flows. For investors, these stats serve as guardrails against overexuberant expectations and remind us to ground forecasts in observable reality.

Practical Examples: Speculative Highs and Realistic Scenarios

Example A: The Viral Social Media Prediction

In 2021, a self-described crypto analyst gained traction by predicting XRP would “inevitably” reach $10,000 after regulatory clarity and mass adoption. Many investors bought in based on this claim. In the years since, XRP’s price has continued to trail far behind, causing some investors to experience significant losses. The lesson: viral predictions without substance offer more risk than reward.

Example B: Measured Institutional Announcement

Contrast this with the measured, stepwise price bumps that followed each Ripple partnership announcement—such as the Western Union pilot in 2018. Prices spiked briefly but normalized as the partnership’s limited scope became clear. This underscores the importance of evaluating not just headline news, but the scale and nature of adoption.

Common Mistakes & How to Avoid Them

- Chasing Hype: Believing in viral, unsupported forecasts without examining the economics or technology creates risk.

- Ignoring Supply Dynamics: Many forecasts gloss over simple math; always check the implied market capitalization.

- Single-Factor Thinking: Assuming that one regulatory win, or one partnership, will trigger a transformational price leap overlooks the complexity of adoption.

- Lack of Diversification: Putting too much capital into XRP based on ambitious predictions exposes portfolios to outsized risk.

Implementation Checklist

- Assess XRP adoption metrics: Track key partnerships and on-chain activity regularly.

- Do the math: Always calculate implied market cap before taking ambitious predictions seriously.

- Monitor regulatory news: Know the status of Ripple’s legal proceedings and policy updates worldwide.

- Balance portfolio risk: Avoid over-allocation to speculative assets based on long-shot targets.

- Revisit and revise your investment thesis: Set regular check-ins to ground decisions in the latest data, not just hope.

Conclusion: Sober Insight on the XRP $10,000–$35,000 Price Prediction

While the dream of XRP soaring to $10,000 or $35,000 per token is compelling, especially for early holders, the economic, technological, and regulatory hurdles make such outcomes essentially implausible with current evidence. Real-world data and historical price action reinforce the need for careful skepticism. For investors, prudent decision-making means tracking actual adoption and regulatory clarity while maintaining realistic expectations. The best path forward is disciplined investing, rooted in facts rather than fantasy—so you can avoid costly mistakes and participate in crypto’s evolution with eyes wide open.

FAQs

Is it realistic for XRP to reach $10,000 or $35,000?

Given the current supply and adoption, such prices would require a global financial transformation and a market capitalization beyond the world’s total assets. It is highly implausible based on present data.

What would need to happen for XRP to achieve those price levels?

XRP would need to become the universal bridge asset in almost all cross-border transactions globally, displacing existing systems, while regulatory and institutional barriers would have to fully disappear—a scenario with extremely low probability.

How can I protect myself from hype-driven predictions?

Always check the math behind price targets, monitor actual adoption rates, and diversify your investments. Relying solely on ambitious forecasts exposes you to undue risk.

What are the main things to watch if I own XRP?

Track new, substantive institutional partnerships, regulatory developments, and rising on-chain utility. These, rather than speculative targets, should guide your evolving investment decisions.

Are there safer ways to invest in crypto than chasing high-altitude XRP predictions?

Consider diversified exposure to established cryptocurrencies, use stop-loss strategies, and focus on assets with growing real-world adoption to manage both opportunity and risk more effectively.

Leave a comment