Introduction: Navigating the Complexity of XRP Crypto Price Prediction

For anyone attempting to decipher the future of cryptocurrency investments, understanding XRP crypto price prediction is both essential and challenging. XRP, the digital currency native to the Ripple network, frequently captures headlines because of its unique value proposition and ongoing regulatory battles. Investors, traders, and crypto enthusiasts want clarity: Will XRP surge, stagnate, or fall behind in an unpredictable market landscape? This article unpacks the key dynamics, frameworks, and data behind XRP crypto price prediction—empowering you to make more informed decisions even amid crypto’s notorious volatility.

XRP Crypto Price Prediction: Definition, Scope, and Context

XRP crypto price prediction refers to the informed estimation of the future market value of XRP, drawing upon analyses of technical indicators, market sentiment, macroeconomic trends, and unique factors like legal proceedings against Ripple Labs. Unlike Bitcoin or Ethereum, XRP’s performance is tightly linked not only to broader crypto movements but also to regulatory developments and adoption within international banking.

Why XRP Price Prediction Matters for Investors

A rigorous approach to XRP crypto price prediction helps investors and traders identify opportunities, manage risk, and adapt to market-moving news. For both individual crypto holders and institutional participants, accurate forecasts can mean the difference between securing gains and incurring losses. Most importantly, understanding what drives XRP’s price—regulatory updates, ecosystem adoption, or the overall cryptocurrency market direction—gives you an edge in tailoring your investment strategy to real-world events and data-driven signals.

Core Framework for XRP Crypto Price Prediction

Accurately forecasting XRP’s price involves a balanced use of technical analysis, fundamental assessment, and market sentiment monitoring. Below are the pillars of a sound prediction strategy:

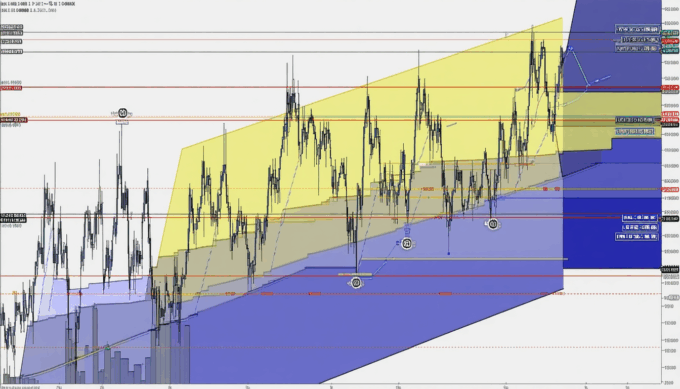

Actionable Pillar 1: Technical Analysis

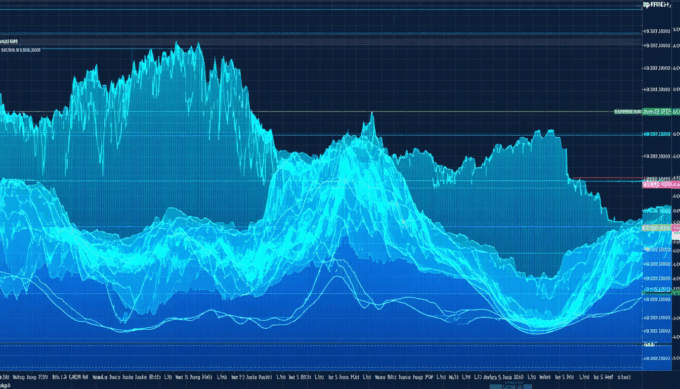

Technical analysis examines price charts, historical data, and trading volume. For XRP, watch for recognizable chart patterns and signals—moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence). Identify support and resistance levels, and observe whether XRP is entering a bullish or bearish trend.

Actionable Pillar 2: Fundamental Catalysts

Fundamental analysis focuses on Ripple’s legal battles, major partnership announcements, and overall adoption in the banking sector. For example, the ongoing SEC lawsuit dramatically affects price movements, with rulings or settlements often causing sharp swings.

Actionable Pillar 3: Sentiment and News Analysis

Monitor social media sentiment, crypto news outlets, and large-market movements. Sudden spikes in positive or negative sentiment online—especially surrounding regulatory milestones or major transactions—can precede significant price changes.

Tools and Metrics for Ongoing Monitoring

- Use established charting platforms for technical indicators.

- Track XRP whale activity through blockchain explorers.

- Stay updated on regulatory news and major court decisions.

- Watch large volume transactions and liquidity flows.

Data & Proof: What the Numbers Say

Key Statistics: XRP Market Performance

- XRP reached an all-time high of $3.84 in January 2018 (CoinMarketCap, 2018).

- In 2023, XRP’s market capitalization fluctuated between $15 billion and $40 billion, with trading volume spikes following SEC case updates (CryptoCompare, 2023).

- Following a partial legal victory for Ripple in July 2023, XRP’s price increased by nearly 70% within 24 hours (Reuters, 2023).

What These Numbers Mean for Investors

The data underscores XRP’s sensitivity to regulatory outcomes and major news events. Price surges often align with favorable legal developments, while downturns follow uncertainty or negative headlines. For investors, this means that XRP crypto price prediction must integrate legal and sentiment analysis alongside traditional technical methods, and risk management is crucial due to the potential for rapid, news-driven swings.

Practical Examples: Price Predictions in Action

Example A: SEC Case Win and Price Spike

In July 2023, a pivotal court ruling declared XRP was “not a security” for certain transactions. Analysts tracking legal updates and rapid sentiment shifts anticipated a price jump. Those who acted on these signals saw XRP climb from around $0.47 to $0.80 in a single day—a clear case where blending technical, sentiment, and news analysis led to actionable insights.

Example B: Overlooking Regulatory Risk

Conversely, many traders in early 2021 ignored mounting legal signals as the SEC initiated its lawsuit. Despite positive technical indicators, XRP’s price fell sharply after the lawsuit announcement, underscoring the danger of relying solely on charts without incorporating legal context.

Common Mistakes in XRP Crypto Price Prediction

- Ignoring Regulatory News: Focusing only on technical trends can cause investors to miss major legal triggers that move XRP’s price dramatically.

- Chasing Hype: Trading based solely on social media chatter or rumors can lead to poor entry and exit points.

- Neglecting Risk Management: Not setting stop-loss orders or position sizing correctly exposes investors to large losses when predictions go awry.

- Forgetting Market Correlation: Overlooking how Bitcoin or broader market movements influence XRP’s price can skew analysis.

Implementation Checklist for Reliable XRP Crypto Price Prediction

- Set up real-time charting tools for technical analysis on XRP.

- Subscribe to reputable newsfeeds monitoring the SEC case and global crypto regulation.

- Analyze on-chain data to spot whale movements and liquidity trends.

- Combine sentiment analysis tools with market headlines for a 360-degree perspective.

- Regularly review your risk tolerance and adjust trading strategies as needed.

- Document your prediction process and outcomes to refine future forecasts.

Conclusion: Synthesizing Insights and Next Steps

Predicting XRP’s future price demands more than simple chart-watching—it requires an integrated approach, combining technical, fundamental, and sentiment-driven analysis. The evidence highlights how regulatory developments and market sentiment can rapidly shift price trajectories, reinforcing the need for investors to stay informed and agile. By applying the practical framework outlined above, you can approach XRP crypto price prediction with a more systematic, data-driven process. Start with small positions, keep learning from each price cycle, and remain vigilant for both technical and news-based market shifts.

FAQs

What factors most affect XRP crypto price prediction?

Key factors include regulatory decisions, especially regarding the SEC lawsuit, global adoption of Ripple’s payment solutions, overall crypto market trends, and large trading volume shifts.

Is technical analysis alone enough for predicting XRP’s price?

No. While technical analysis provides valuable signals, integrating legal news and sentiment analysis is essential for a holistic XRP crypto price prediction strategy.

How often should I review my XRP price predictions?

You should review your forecasts regularly, especially before and after major legal or market news, and after significant technical or sentiment shifts.

Can XRP reach its previous all-time high soon?

Given its past performance and current regulatory environment, it may be challenging in the short term, but sudden legal breakthroughs or mass adoption could quickly alter this outlook.

Where can I find reliable data for XRP analysis?

Trustworthy market data platforms, blockchain explorers, and verified news sources all offer up-to-date insights crucial for informed XRP crypto price prediction.

“`

Leave a comment