Navigating Sol USDT Price Current: What Traders Need Now

Every crypto trader knows the importance of quick, reliable price data—especially when it comes to fast-moving pairs like Sol USDT. In the dynamic world of digital assets, keeping a pulse on the Solana to Tether rate isn’t just about curiosity—it’s about taking informed action, whether you’re a seasoned swing trader or someone exploring Sol for the first time. In this guide, you’ll discover what drives the Sol USDT price current, why it matters right now, and how to stay ahead with sound strategies and practical checks.

Understanding the Sol USDT Price Current

In crypto markets, “Sol USDT price current” refers to the live exchange rate between Solana (SOL) and Tether (USDT). Solana is recognized for its ultra-fast blockchain and growing DeFi ecosystem, while USDT (Tether) is a leading stablecoin, offering a US dollar peg for stability in volatile environments. This pair is a go-to for traders wanting both speed (via Solana) and safety (via USDT).

Why Sol USDT Price Current Matters for Traders

For traders and investors, the live Sol USDT rate informs decisions on timing—buying dips, capturing gains, or hedging market exposure. Solana’s price often reflects general sentiment in the altcoin market; meanwhile, using USDT as a quote currency helps you move quickly between crypto and a dollar-equivalent base. Fast, precise price data enables you to minimize slippage, control risk, and execute strategies that work in your favor. Outcomes include more consistent entries/exits, better risk management, and enhanced profit potential.

A Strategic Approach to Tracking and Using Sol USDT Price

Success with Sol USDT goes beyond simply glancing at an exchange app. It requires understanding the factors influencing price and knowing exactly when and how to make your moves.

Pillar 1: Recognize Key Market Drivers

- Market Sentiment: News, social media, and general sentiment about Solana or crypto impact SOL price moves.

- Network Health: Solana’s blockchain performance and updates (e.g., outages or upgrades) cause price volatility.

- Macro Conditions: Bitcoin trends, inflation data, or global regulatory updates often ripple through all major crypto pairs, including Sol USDT.

Pillar 2: Use Reliable Price Feeds and Alerts

Rely on high-quality sources for the Sol USDT price current. Major exchanges update rates by the second, but for sharp moves, use price alerts and API feeds (such as TradingView widgets or exchange native tools) to notify you of key levels without constant screen time. Consistent, trusted data is non-negotiable for active trading.

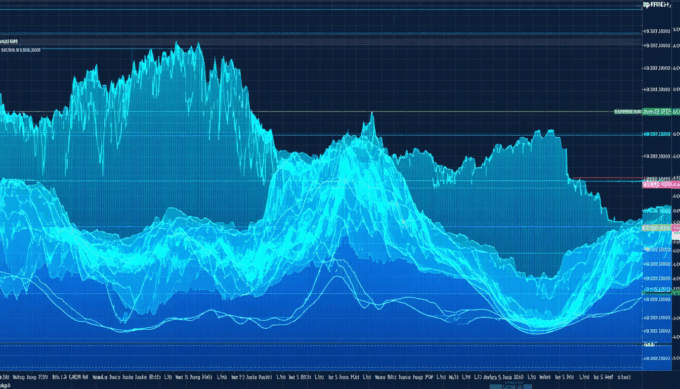

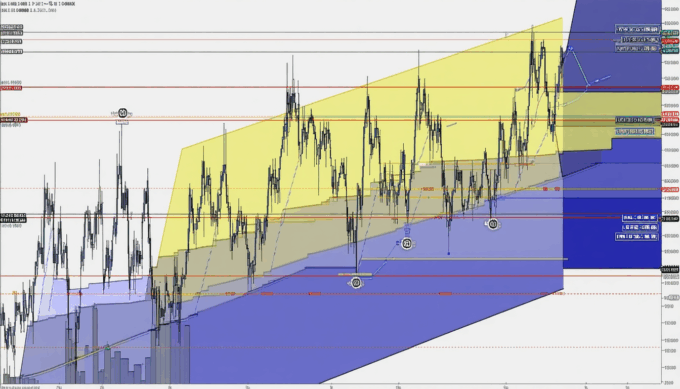

Pillar 3: Technical and Volume Analysis

Study chart patterns (like support/resistance, moving averages), but don’t neglect volume. Spikes in volume often precede significant price movements—watching these can help you anticipate breakouts or corrections. Combine this with RSI or MACD indicators for a more nuanced view.

Pillar 4: Timing and Execution

- Dollar-Cost Averaging (DCA): If you’re investing, consider splitting entries to avoid catching tops.

- Limit Orders: Use them to buy below or sell above the Sol USDT price current, skipping the risk of emotional market orders.

- Stop-loss Orders: Protect capital by automating exits below key levels.

Monitoring Tools and Decision-Making Metrics

- Real-Time Exchange Data: Use apps or web platforms from top exchanges for minute-to-minute prices.

- Price Alert Apps: Mobile tools enable alerts for specific Sol USDT price triggers (such as CryptoCompare or CoinGecko apps).

- Liquidity and Order Book Checks: Thin order books can lead to price slippage; check these metrics before large trades.

Data & Proof: The Power of Real-Time Trading

Key Statistics Shaping Sol USDT Trading

- In early 2024, over 27% of Solana trading volume paired with USDT on major exchanges (CoinMarketCap, 2024).

- Solana processed a record 100 million daily transactions in Q1 2024, with Tether among its most used stablecoins (Solana Foundation, 2024).

- Price spikes of 10%+ in a single day have occurred more than a dozen times for Sol USDT in the past year (CryptoCompare, 2024).

What These Numbers Mean for Today’s Traders

The high volume and frequency of price swings reveal both opportunity and risk. If you’re tracking Sol USDT price current, you’re in one of the fastest markets—where speed, data integrity, and execution tools can drive actual results. For those actively managing entries and exits, the combination of deep liquidity and frequent volatility is a double-edged sword requiring discipline and reliable monitoring.

Examples: Putting Strategy into Action

Example A: Catching the Breakout

Setup: An active trader notices a consolidation pattern around $120 SOL/USDT.

Action: Using live price alerts and trading view indicators, they place a buy order just above resistance at $123, confirmed by a volume surge.

Result: As Solana rallies to $134 within hours, the trader locks in a 9% profit, thanks to timely data and a pre-set strategy.

Example B: Avoiding a Market Drop

Setup: Another trader observes unusual delays on the Solana network and negative news headlines.

Action: Instead of reacting, they consult exchange depth charts, see thinning liquidity, and set a stop-loss at $118 while holding.

Result: When SOL quickly drops to $112, their automated stop protects the majority of their capital, confirming the value of a disciplined exit plan.

Common Mistakes and How to Avoid Them

- Chasing Hype: Rushing in when Sol USDT price current spikes, often leads to buying tops or panic selling bottoms. Instead, set entry/exit prices in advance.

- Ignoring Order Books: Placing large trades without checking liquidity can cause unnecessary slippage.

- Neglecting Network Factors: Overlooking blockchain congestion or technical updates may blindside short-term trades—always check Solana network status before big moves.

- No Stop-Loss Discipline: Trading without clear boundaries exposes you to outsized losses during sudden moves.

Implementation Checklist

- Monitor the Sol USDT price current via reputable exchanges or apps—refresh often.

- Set up price alerts for both breakout and support/resistance levels to automate response.

- Regularly check Solana network health and major news sources to anticipate volatility.

- Use limit and stop-loss orders rather than chasing market trades.

- Analyze both technical indicators and volume alongside live price data before executing.

- Review your results monthly to refine strategies.

Conclusion: Taking Charge of Your Sol USDT Trading

Staying on top of the Sol USDT price current isn’t merely about curiosity—it’s essential if you want to make smarter, safer moves in volatile crypto markets. By combining real-time data, disciplined strategies, and robust monitoring tools, you position yourself to seize opportunities and dodge common pitfalls. Start by tracking reliable prices, set clear trading rules, and revisit your system regularly—because in fast-moving pairs like SOL/USDT, informed action is everything.

FAQs

How do I check the live Sol USDT price current?

Use reputable exchange platforms or price alert apps for minute-to-minute Sol USDT price updates. Be sure to refresh often and cross-verify between platforms for accuracy.

What makes Solana to Tether (SOL/USDT) so popular among traders?

High liquidity, fast transaction times, and low fees draw traders to SOL/USDT, making it ideal for both quick trades and larger moves.

How can I protect against sudden price drops in the Sol USDT pair?

Utilize stop-loss orders and monitor Solana network health to avoid unexpected losses. Setting alerts and using limit orders also help manage risk.

What indicators work best with Sol USDT price current analysis?

Moving averages, RSI, volume trends, and order book depth are effective tools for analyzing live Sol USDT price movements and setting entry/exit points.

Are there times when trading SOL/USDT is riskier?

Periods of high volatility—often during major network updates, unforeseen outages, or big news—can increase risk; always check current network status and market sentiment before trading.

Leave a comment