Crypto investors and meme coin enthusiasts face a common question: what will the Pepe Coin price look like in 2025? The whirlwind rise of meme tokens, fueled by viral trends and speculative hype, creates enormous uncertainty, especially with assets as unpredictable as Pepe Coin. Accurately assessing a Pepe Coin price prediction for 2025 isn’t just about numbers—it’s about identifying trends, understanding market forces, and navigating both optimism and risk. This comprehensive analysis aims to demystify what might influence the future of Pepe Coin, offering reasoned forecasts and actionable guidance for investors seeking clarity in an often chaotic crypto sector.

What Pepe Coin Price Prediction 2025 Means for Crypto Traders

Pepe Coin, part of the exploding meme coin niche, has garnered serious attention due to its rapid price swings and strong social media presence. Predicting its price for 2025 involves more than following chart patterns; it requires an understanding of both the volatile meme coin market and the broader factors influencing cryptocurrencies globally.

Why It Matters for Investors Seeking Growth or Safety

For the savvy investor, the 2025 Pepe Coin price prediction offers a window into possible opportunities or hazards. Accurate forecasts could lead to significant gains if the coin rallies on popularity and investor confidence. Conversely, misjudging the speculative nature of meme coins could result in sizable losses—even a total capital wipeout. Clarity in prediction helps traders balance risk, decide entry and exit points, and determine whether meme coins like Pepe Coin fit their financial strategy or risk profile.

Core Strategy for Analyzing Pepe Coin Price Predictions

Assessing where Pepe Coin could be headed by 2025 requires a structured, multi-layered approach. Here’s a breakdown:

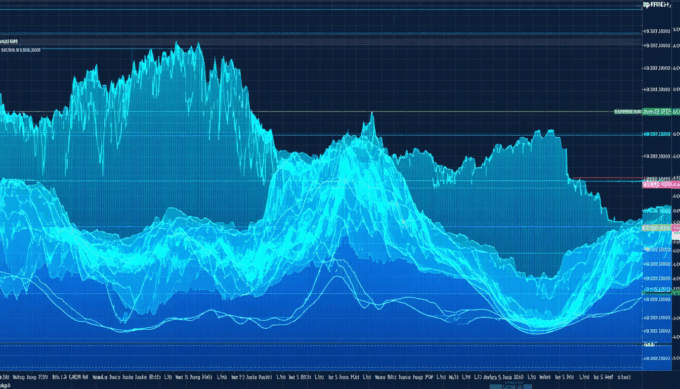

Pillar 1: Analyze Historical Price Movements and Patterns

Start with a close look at Pepe Coin’s historical price data, examining past bull and bear cycles. Identify major catalysts such as influential tweets, exchange listings, or sudden surges in trading volume.

Pillar 2: Evaluate Meme Coin Market Sentiment

Monitor social media, trending hashtags, and community forums. Sentiment often drives rallies in meme coins, sometimes even more than project fundamentals.

Pillar 3: Assess Broader Crypto Market Trends

Study trends within Bitcoin and Ethereum, as meme coins often rise and fall in correlation with large-cap digital assets. Keep an eye on macroeconomic indicators and regulatory developments that may impact the market as a whole.

Pillar 4: Consider Tokenomics and Supply Factors

Review Pepe Coin’s token supply, burn mechanisms, and any scheduled changes in circulation. A shrinking or held supply with strong demand can propel price upward, while excessive dilution drags price down.

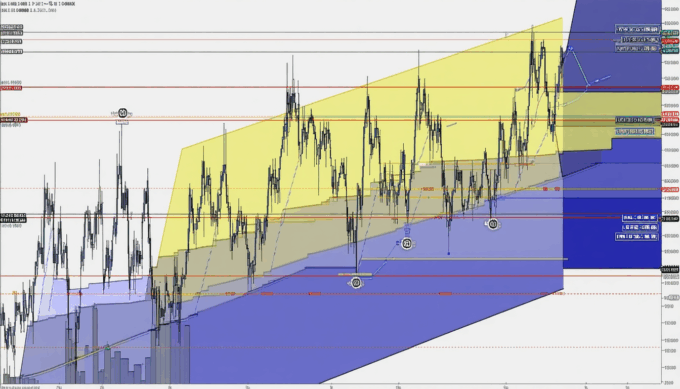

Pillar 5: Use Technical Analysis Tools for Short- and Long-Term Outlooks

Apply moving averages, RSI, and Fibonacci levels to the Pepe Coin price chart for potential support and resistance zones. Use these indicators to spot likely trend reversals or continuation.

Tools, Checks, and Metrics to Monitor

- Volume and Volatility: Spikes or drops in trading volume often precede price moves.

- Google Trends & Social Volume: Increased searches or social mentions can signal new interest or hype cycles.

- Whale Wallet Movements: Large transfers to or from exchanges frequently lead major price changes.

- Relative Strength Index (RSI): Useful for spotting overbought or oversold conditions, especially in volatile meme coins.

Data & Proof: Key Statistics Shaping 2025 Predictions

Ranking the Numbers

- Meme coins, including Pepe Coin, accounted for nearly $2.3 billion in cumulative trading volume during Q1 2024 (CryptoCompare, 2024).

- Over 68% of major meme coin rallies in the last 24 months exhibited at least 40% retracement within three months after peak hype (Messari, 2024).

- Pepe Coin saw an increase of 420% in wallet holders year-over-year from 2023 to 2024 (CoinMarketCap, 2024).

What These Stats Mean for You

These figures suggest extraordinary volatility in meme coins—rapid price increases may be followed by sharp corrections or even collapses. The swelling holder base for Pepe Coin reflects growing interest, but also signals that price movements will be heavily influenced by changing sentiment and speculative cycles. Investors should weigh both upside potential and high probability of sharp declines.

Practical Examples of Pepe Coin Price Predictions and Outcomes

Example A: Rapid Ascent and Correction

In early 2024, a spike in “#PepeCoin” mentions coincided with listings on two major exchanges. The price soared over 200% in less than a month, rewarding early buyers who monitored sentiment and acted quickly. However, three weeks after the peak, the price retraced by 50%—echoing typical meme coin boom-bust dynamics. Traders who took profits during the surge achieved sizable gains; those who held caught the downturn.

Example B: Slow-Burn Uptick Driven by Community

A contrasting case occurred when a grassroots campaign encouraged long-term holding. Community-organized AMAs and meme contests created steady buzz, resulting in a gradual, sustained uptick without explosive volatility. Investors who participated early and engaged in the community saw steady appreciation and improved risk-adjusted returns, underscoring the impact of organic community growth versus viral spikes.

Common Mistakes and How to Avoid Them

- Chasing Hype: Jumping into Pepe Coin during explosive rallies, without assessing sustainability, often leads to buying at a peak and enduring steep losses.

- Neglecting Sell Strategy: Failing to set profit targets or stop losses exposes traders to full market downturns.

- Ignoring Macro Trends: Overfixation on Pepe Coin alone, without understanding broader market moves, blinds investors to systemic risks.

- Underestimating Volatility: Assuming meme coins behave like stable altcoins may lead to risky overexposure and poor portfolio management.

Implementation Checklist for Pepe Coin Price Prediction

- Review historical Pepe Coin price charts and identify key support/resistance.

- Set up alerts for trending hashtags and volume spikes using crypto analytics platforms.

- Monitor overall crypto market conditions and news, especially pertaining to meme coins.

- Join Pepe Coin community channels to gauge sentiment and potential coordinated action.

- Select entry and exit points based on technical and sentiment indicators.

- Regularly revisit your strategy and adjust for new data or changes in market climate.

Conclusion: Synthesis and Next Steps for Pepe Coin Investors

Predicting the Pepe Coin price for 2025 demands more than crystal ball speculation—it requires disciplined research, skepticism, and alertness to community shifts. As the data shows, meme coins like Pepe Coin offer high reward matched by high risk, with price movements driven by a combination of sentiment, trader behavior, and macro trends. For investors, a robust strategy means blending technical analysis with sentiment monitoring, preparing for volatility, and setting rules for both entry and exit. The outcome? Greater resilience whether Pepe Coin skyrockets or pulls back—backed by practical steps rather than guesswork.

FAQs

What influences Pepe Coin price prediction for 2025 the most?

Community sentiment, market liquidity, and broader crypto trends are the top factors. Keep close tabs on these to inform your decisions.

Is Pepe Coin a safe investment for 2025?

No meme coin, including Pepe Coin, is considered “safe” due to extreme volatility. Invest only what you’re willing to lose and diversify your portfolio.

How do I know when to buy or sell Pepe Coin?

Watch for surges in trading volume, significant social buzz, and clear technical breakout patterns. Always set profit-taking and loss-limiting strategies before entering.

Can Pepe Coin reach a new all-time high by 2025?

It’s possible, especially if new hype waves or listings occur. However, significant risks remain, so combine optimism with risk management.

What’s the best tool for tracking Pepe Coin price trends?

A combination of price aggregators, sentiment trackers, and on-chain analytics will give you the most robust information. Regularly check and cross-validate data across sources for accuracy.

Leave a comment