Navigating the ETH USDT Price Current: Your Guide to Real-Time Ethereum to Tether Rates

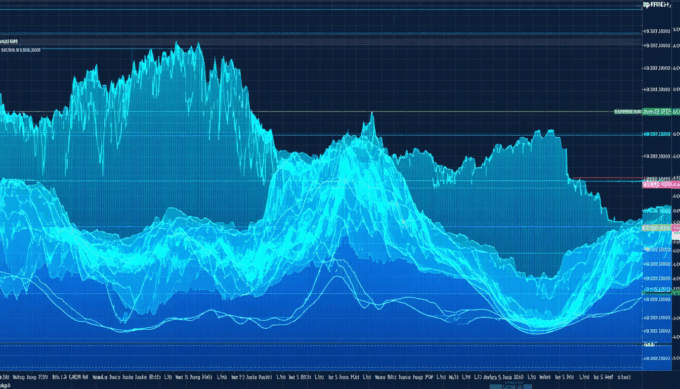

Anyone who has spent even a short time following cryptocurrency markets knows how quickly prices can shift. For traders, investors, and curious observers alike, tracking the ETH USDT price current — the real-time value of one Ethereum (ETH) in Tether (USDT) — is central to making smart, timely decisions. In a world where volatility is the rule rather than the exception, staying updated on this pairing can mean the difference between a winning trade and a missed opportunity. This article unpacks what ETH/USDT represents, practical strategies for tracking the rate, essential data, common pitfalls, and actionable steps to keep you ahead in the ever-evolving crypto scene.

What ETH USDT Price Current Means in Crypto Markets

Ethereum (ETH) paired with Tether (USDT) is one of the most heavily traded cryptocurrency pairs on global exchanges. “ETH USDT price current” refers to the latest exchange rate showing how many Tether (a dollar-pegged stablecoin) you receive per Ethereum. Since USDT closely tracks the US dollar, this pair provides a clear, stable reference for Ethereum’s dollar value, filtering out the noise of traditional fiat conversion steps.

Why the ETH/USDT Rate Matters for Crypto Traders

For anyone engaging in crypto — from day traders looking to exploit intraday volatility to long-term holders watching market trends — knowing the ETH USDT price current is crucial. Not only does it shape the value of portfolio holdings, but it also informs decisions like when to buy, sell, or rebalance assets. The ETH/USDT pair is the backbone of liquidity on most leading exchanges, making it the preferred reference for real-time Ethereum pricing and reliable for assessing market sentiment.

How to Track and Interpret the ETH USDT Price Current

Effective crypto decision-making starts with understanding how to monitor and interpret this key rate. The following steps offer a solid framework for anyone seeking to act on live price data.

Actionable Pillars for Monitoring ETH/USDT

1. Use Reputable Crypto Exchanges for Live Quotes

Major exchanges like Binance and Coinbase display the most up-to-date ETH USDT price current thanks to high liquidity and tight spreads. Always compare across several platforms to spot significant discrepancies and avoid thinly traded markets.

2. Leverage Dedicated Price Tracking Tools

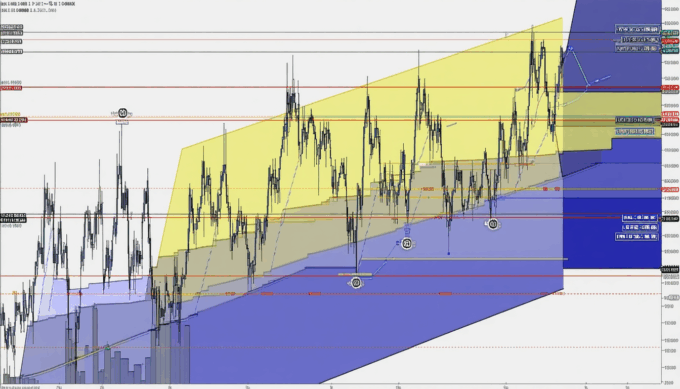

Platforms such as TradingView offer advanced charts and alerts. Customize your view, set up thresholds for price movement notifications, and monitor historical price action with technical indicators like moving averages or RSI. This empowers traders to react swiftly during market swings.

3. Understand the Spread and Order Book

The small gap between buy (bid) and sell (ask) prices, known as the spread, is especially important during periods of high volatility. Reviewing the order book depth can help you spot potential support and resistance zones, as well as detect sudden liquidity shifts that might precede sharp moves.

4. Monitor Real-Time News and On-Chain Data

ETH USDT price current is often influenced by macroeconomic events or Ethereum-specific news such as network upgrades, regulatory announcements, or large on-chain transactions. Tools like CryptoQuant provide real-time analytics on whale movements and market flow.

Key Metrics for ETH/USDT Monitoring

- Trading Volume: Indicates interest, confirming whether price moves are backed by strong participation.

- Volatility Index: Highlights periods where ETH/USDT can swing significantly, often aligning with opportunity — or risk — for active traders.

- 24-hour High/Low: Shows the price range for the current day, indicating potential breakout levels or reversals.

Data & Proof: ETH/USDT Volume, Market Influence, and Volatility

Key Statistics from Recent Market Data

- ETH/USDT consistently ranks among the top three most traded crypto pairs globally, accounting for over $20 billion in daily volume (CoinMarketCap, 2024).

- The average 24-hour volatility for ETH/USDT has hovered between 3-5% during 2023 and early 2024, compared to less than 1% for traditional forex pairs (Binance Research, 2024).

- In 2023, 80% of spot Ethereum trades on major platforms settled via stablecoins, with USDT as the dominant counterparty (CryptoCompare, 2023).

What These Numbers Mean for Traders

These statistics paint a clear picture: ETH USDT price current is not only highly liquid but also more volatile than many other asset classes, creating both opportunity and risk. For active traders, this means there’s ample room to capitalize on price swings — but also a greater need for discipline, robust risk management strategies, and timely information.

Practical Examples: Using ETH/USDT Analysis for Better Trading Outcomes

Example A: Day Trading on Momentum

Consider Anna, a day trader who monitors ETH USDT price current on TradingView. She sets alerts for when Ethereum breaks above or below key intraday levels, confirmed by above-average trading volume. By acting quickly on a bullish breakout, she enters a position and captures a quick 2% gain before momentum fades. This approach exemplifies how real-time metrics and charting tools lead to measurable, tangible profits.

Example B: Long-Term Investing vs. Short-Term Volatility

In contrast, Michael prefers a long-term approach. He watches large-scale shifts in ETH USDT but avoids knee-jerk reactions to hourly price moves. During volatile days, Michael sticks to his dollar-cost averaging plan, using the ETH/USDT rate as his purchase benchmark. His discipline results in reduced emotional trading and a more stable rate of portfolio growth over time.

Common Mistakes When Using ETH USDT Price Current — And How to Avoid Them

Tracking the ETH USDT price current is powerful, but pitfalls abound. Here are the most common missteps:

- Relying on a Single Data Source: Some traders check only one exchange or aggregator, missing out on price discrepancies and fake volumes.

- Chasing Volatility Blindly: Acting impulsively on every price swing, especially in highly volatile hours, can rack up losses.

- Ignoring Fees and Slippage: Neglecting trading fees or order book depth can erode profits, especially in fast-moving markets.

- Failing to Use Stop-Loss Orders: Trading without risk controls can expose your portfolio to damaging losses during sudden downturns.

To avoid these, always cross-reference prices, use alerts to remain disciplined, factor in all trading costs, and establish clear risk controls.

Implementation Checklist for ETH/USDT Rate Tracking

- Identify and bookmark reputable exchanges showing live ETH USDT price current.

- Set up real-time price alerts on TradingView or your exchange’s native app.

- Regularly review trading volumes and volatility indicators for context.

- Monitor order books and confirm price moves with volume before executing trades.

- Stay updated with Ethereum network news and macro market trends.

- Journal your trades and outcomes to refine your tracking strategy over time.

Conclusion: Staying Ahead with Real-Time ETH USDT Price Current

Being attuned to ETH USDT price current is fundamental for anyone navigating the crypto ecosystem, from quick-footed traders to thoughtful investors. By prioritizing reputable data sources, leveraging robust tools, and adhering to disciplined trading routines, you can capitalize on market opportunities and manage risks effectively. With the practical examples, metrics, and stepwise strategies outlined above, staying ahead of the curve is less about luck—and more about informed, deliberate action. Let today be the start of a more strategic approach to tracking and trading Ethereum to Tether rates.

Leave a comment