Navigating Uncertainty: Why 2025 Matters for Dogecoin Price Prediction

As the crypto market grapples with volatility and shifting investor sentiment, everyone from seasoned traders to casual holders wants a reliable Dogecoin price prediction for 2025. The stakes are real: a well-timed decision could mean substantial profit or a costly misstep. This article provides a detailed, evidence-based outlook on where Dogecoin might head by 2025, blending technical analysis, expert perspectives, and real-world outcomes. By the end, readers will gain practical tools and strategic context to make confident choices about DOGE’s future.

Defining Dogecoin Price Prediction 2025: Scope and Relevance

Dogecoin price prediction 2025 refers to informed projections about DOGE’s potential market value by the year 2025. Unlike short-term forecasts, this outlook considers macro trends—blockchain adoption, regulatory moves, and major economic drivers. While Dogecoin began as a meme coin, it now garners attention from serious investors due to its vibrant community and integration into payments systems.

Why Dogecoin Price in 2025 Matters for Investors

An accurate prediction helps investors make decisive moves, from diversifying portfolios to timing their entry and exit. For traders, it means identifying clear targets for profit-taking or loss limitation. For everyday holders, understanding the likely trajectory of Dogecoin can determine whether holding or selling aligns with financial goals. Ultimately, a clear view of DOGE’s 2025 prospects brings control to a market often dominated by uncertainty.

Core Strategies for Predicting Dogecoin’s 2025 Price

Forecasting crypto prices is both an art and a science. The following pillars outline how to develop a robust Dogecoin price prediction for 2025.

1. Analyze Historical Trends

Start with DOGE’s price history, noting cycles of rapid growth and sharp corrections. Identify key events—such as social media surges or policy announcements—that have correlated with past price shifts.

2. Evaluate Market Fundamentals

Monitor on-chain data like transaction volume, wallet activity, and mining rates. Higher transaction activity often signals growing adoption and potential price strength, while declining metrics may flag weakening demand.

3. Assess Sentiment and Community Momentum

Dogecoin’s community is a major market mover. Track social metrics: trending hashtags, online mentions, and celebrity endorsements. Shifts in buzz often presage notable price movements.

4. Scrutinize External Catalysts

Look at broader factors: institutional adoption, regulatory clarity around cryptocurrencies, and technological upgrades (such as DOGE’s ongoing integration with payment platforms). Each can tip the price balance quickly in either direction.

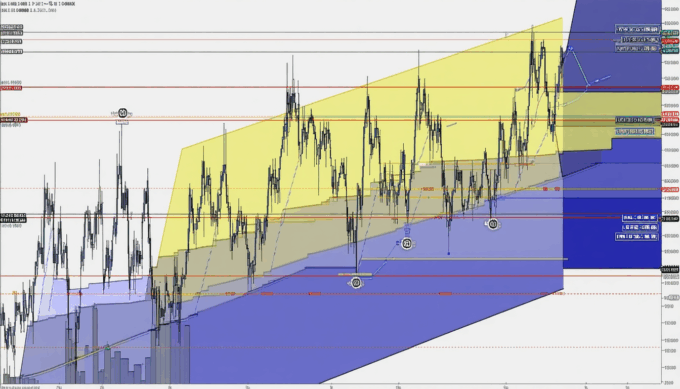

5. Balance Quantitative Models with Expert Opinion

Leverage pricing models (e.g., moving averages, Fibonacci retracements) and cross-check these with authoritative analyst forecasts. For Dogecoin in particular, consensus among crypto experts can help contextualize otherwise ambiguous data points.

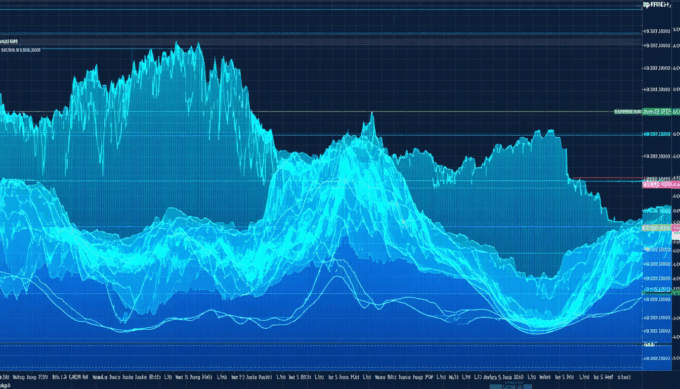

Monitoring Tools and Metrics

Successful prediction relies on real-time data. Use platforms like CoinMarketCap or TradingView for live DOGE statistics. Set up alerts for major news or whale transactions—these often foreshadow big shifts. Regularly reviewing technical indicators (RSI, MACD, support/resistance levels) ensures your predictions are grounded and adaptable.

Data & Proof: What the Numbers Reveal

Key Dogecoin Statistics Relevant to 2025

- Dogecoin saw a peak market cap of over $88 billion during the 2021 bull run (CoinMarketCap, 2021).

- In 2023, nearly 50% of DOGE transactions involved retail investors under 30, indicating continued appeal among young traders (Crypto.com, 2023).

- Daily DOGE transaction volumes averaged $1.5 billion in Q1 2024, showing sustained interest despite broader market fluctuations (IntoTheBlock, 2024).

What These Stats Imply for Investors

These figures demonstrate Dogecoin’s capacity for explosive growth, largely fueled by retail enthusiasm and viral trends. The sustained transaction volumes and youthful investor base suggest DOGE is not a passing fad—it remains relevant as younger generations embrace crypto. Still, Dogecoin’s price prediction for 2025 must account for high volatility, meaning strategies should emphasize both upside potential and risk management.

Practical Examples of Dogecoin Price Forecasting

Example A: Community-Fueled Surge

In early 2021, coordinated social media activity saw Dogecoin prices skyrocket from under $0.01 to over $0.70 in mere months. Investors who tracked online momentum and entered early realized outsized returns—some multiplying their capital by 50x. This illustrates the outsized impact that community sentiment can wield over DOGE’s value.

Example B: Institutional Interest and Correction

Conversely, in 2022, heightened regulatory scrutiny cooled enthusiasm for meme coins. DOGE’s price corrected sharply, underscoring the importance of watching macro and policy trends alongside grassroots buzz. Long-term investors who balanced hype with fundamentals weathered the storm more effectively, illustrating the value of a multi-faceted approach in Dogecoin price prediction.

Common Pitfalls and How to Dodge Them

- Chasing Hype Without Due Diligence: Jumping in solely because of trending news can lead to poor timing and losses as swift corrections follow retail surges.

- Ignoring Fundamental Weaknesses: Overlooking on-chain slowdowns, stagnating development, or low transaction volume increases the risk of investing at inflated prices.

- Over-Reliance on Short-Term Patterns: Relying exclusively on technical signals without context (e.g., sudden swings linked to celebrity tweets) can cloud longer-term judgment.

- Neglecting Risk Management: Failing to set stop-losses or diversify positions puts portfolios at unnecessary risk in this highly volatile space.

Implementation Checklist for Predicting Dogecoin 2025 Price

- Gather historical DOGE price data and annotate with key news and events.

- Review on-chain analytics weekly for changes in transaction volume and wallet activity.

- Monitor crypto community forums and major social platforms for sentiment shifts.

- Stay informed of legislative updates and institutional adoption plans.

- Apply both technical analysis and summary analyst forecasts to set reasonable price targets.

- Set up personalized price and news alerts for rapid response to market moves.

- Regularly revisit and adjust your prediction framework as new information emerges.

Conclusion: Sizing Up Dogecoin’s 2025 Outlook

Dogecoin price prediction for 2025 requires balancing hard data, community psychology, and macroeconomic trends. Investors must contend with volatility but can gain an edge by following a structured approach—analyzing history, fundamentals, sentiment, and expert models while safeguarding against hype-driven missteps. With robust strategy, real-time tools, and a critical mindset, investors can approach DOGE’s future with both caution and optimism. Consider these steps and signals as your roadmap; revisit them as the landscape evolves to strengthen your investment decisions.

FAQs

1. What makes Dogecoin price prediction for 2025 challenging?

Predicting Dogecoin’s 2025 price is tough because the coin is influenced by viral trends, celebrity endorsements, and unpredictable market shifts. Combining historical data with real-time sentiment gives the most reliable outlook.

2. Should I rely solely on technical analysis for DOGE predictions?

No. While technical analysis helps spot trends, pairing it with fundamental factors, news events, and regulatory updates produces a clearer, more balanced Dogecoin price prediction for 2025.

3. What risks should I consider before investing in Dogecoin for 2025?

Volatility, regulatory shifts, and changes in social sentiment all affect DOGE’s future price. Risk management—including position sizing and regular review of news—is essential for responsible investing.

4. How often should I update my Dogecoin outlook ahead of 2025?

Regular reviews—monthly or after major news—keep your Dogecoin price prediction realistic and actionable. Adapting to changing data ensures your plan stays aligned with market realities.

5. Is Dogecoin still a good investment for young crypto traders?

Dogecoin continues to attract younger investors with its strong community and viral appeal. Still, balancing enthusiasm with disciplined strategy supports better long-term results.

Leave a comment