Introduction: Navigating the Uncertainty of Bitcoin Price Prediction Today

Every day, traders, investors, and crypto enthusiasts wake up to a new question: what’s happening with Bitcoin’s price? The relentless volatility of the world’s most talked-about cryptocurrency means fortunes can shift within hours. If you’re searching for a reliable bitcoin price prediction today, you’re not alone—it’s a universal problem compounded by market noise, hype, and constant news cycles. The goal of this analysis is to cut through speculation and equip you with clear methods, evidence, and practical steps to make an informed, up-to-date decision.

What Bitcoin Price Prediction Today Means for Crypto Investors

Bitcoin price prediction today refers to short-term, data-driven analysis aiming to forecast Bitcoin’s value within the next 24 hours, based on technical signals, market sentiment, and macroeconomic developments. Unlike long-term projections, today’s forecast must respond quickly to global headlines, regulatory updates, and sudden swings in trading volume. For traders and investors, this insight isn’t just convenient—timely predictions can help manage risk, maximize gains, and avoid emotional decision-making in a high-stakes environment.

Why Bitcoin Prediction Matters for Investors

Rapid and accurate bitcoin price prediction today plays a critical role for active participants. If you’re holding Bitcoin or considering a buy/sell decision, today’s forecast influences when and whether you move. Timely insights affect your profit margins, help protect against sudden downturns, and provide structure in an otherwise unpredictable market. In short, knowing what to expect today helps you act instead of react—an edge every trader appreciates.

Core Strategy for Today’s Bitcoin Price Prediction

Predicting Bitcoin’s price for the day demands a disciplined framework. Let’s break this down into actionable pillars:

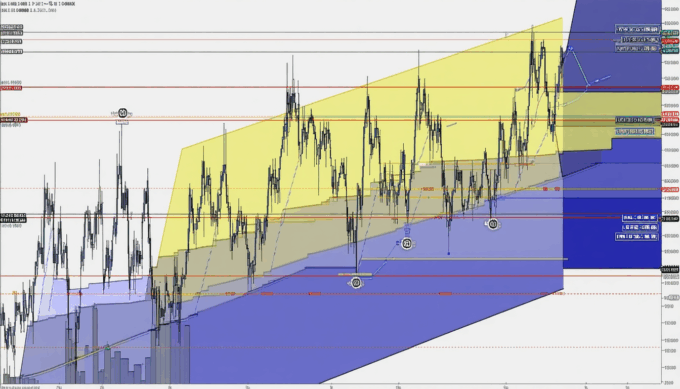

1. Technical Analysis: Candlesticks, Patterns, and Indicators

Start with the basics: examine intraday charts (15-min, 1-hour, 4-hour) for price patterns such as support, resistance, trendlines, and key candlestick formations. Popular indicators—like the Relative Strength Index (RSI), Moving Averages (MA), and MACD—are essential. For example, an RSI approaching 70 suggests overbought conditions, while a bullish crossover on MACD could signal upward momentum.

Decision Criteria:

– Look for confluence—a combination of signals, like RSI confirmation and a moving average crossover.

– Beware of false positives during periods of low trading volume or outside normal market hours.

2. Market Sentiment: News, Social, and Order Book Analysis

Market sentiment can turn the tide within minutes. Monitor cryptocurrency news feeds, regulatory updates, and influential Twitter accounts. Platforms that track sentiment, such as Crypto Fear & Greed Index, provide quick snapshots. On-chain analytics, like wallet movements and order book depth, offer clues about big trades or market manipulation.

Decision Criteria:

– Give more weight to regulatory announcements or large exchange inflows/outflows.

– Use sentiment as a filter—combine it with technical triggers rather than acting on it alone.

3. Macroeconomic Signals

Bitcoin is no longer detached from global finance. Track key macro trends, such as U.S. inflation data, central bank announcements, or major geopolitical shifts. These events often correlate with sudden Bitcoin price jolts, as seen after Fed rate decisions or unexpected global headlines.

Decision Criteria:

– If major macro events are on the calendar, expect heightened volatility and consider smaller position sizes.

4. Tools and Metrics to Monitor

Reliable predictions depend on quality data. Essential tools include:

– TradingView for charts and technical patterns

– Glassnode or CryptoQuant for on-chain analytics

– Coin Metrics or Messari for real-time sentiment and volume data

– Crypto Fear & Greed Index for quick market mood checks

Develop the habit of cross-checking at least two sources before making calls.

Data & Proof: Market Evidence for Today’s Prediction

Recent Bitcoin Market Statistics

- As of early 2024, Bitcoin’s daily average price volatility remains high—often exceeding 4% swings within 24 hours (Coin Metrics, 2024).

- Trading volume on major exchanges like Binance and Coinbase has risen sharply, with February 2024 posting a 30% increase compared to late 2023 (The Block Research, 2024).

- The Crypto Fear & Greed Index hit “Greed” levels above 70 thrice in the last month, highlighting a trend towards bullish market sentiment (Alternative.me, 2024).

What These Numbers Mean for Today’s Trader

These statistics signal a market ripe with opportunity but fraught with risk. High volatility means quick profits or losses; increased trading volume points to active institutional and retail participation. For anyone seeking a bitcoin price prediction today, the implication is clear: stay alert, use stop-losses, and adapt strategies to fast-changing conditions.

Practical Examples of Daily Prediction in Action

Example A: Technical Confluence for a Buy Signal

An active trader spots a bullish engulfing pattern on the hourly BTC/USD chart while both RSI and MACD indicate growing strength. At the same time, positive news about a major bank integrating Bitcoin boosts sentiment. The trader commits to a position, sets a tight stop-loss, and exits with a 3% profit after a two-hour rally—directly benefiting from a disciplined, evidence-based daily prediction.

Example B: False Signal and Risk Management

On another day, social media buzz sparks rumors of a regulatory crackdown. Panic selling pushes prices below key support, but no major news follows. Relying on technical confirmation, a cautious trader waits out the noise and avoids a hasty loss. The price quickly rebounds, validating a cautious, research-driven approach to intraday prediction.

Common Mistakes in Daily Bitcoin Price Prediction

Many traders fall prey to common errors:

- Chasing Hype: Trusting rumors or viral tweets without evidence leads to poor entries.

- Ignoring Volume: Focusing only on price while overlooking volume and order flow can result in traps during illiquid periods.

- Overleveraging: Attempting to “guarantee” short-term gains by using high leverage increases the risk of liquidation in volatile conditions.

- Lack of Stop-Loss: Failing to set risk controls exposes traders to catastrophic losses if the market moves sharply against them.

Implementation Checklist for Today’s Forecast

- Check the Economic Calendar: Note any major announcements or events that may impact Bitcoin.

- Analyze Price Action: Identify support/resistance, chart patterns, and key indicators.

- Assess Sentiment: Review the Crypto Fear & Greed Index and trending news/headlines.

- Validate with On-Chain Data: Examine large wallet flows or exchange inflows/outflows.

- Set Entry and Exit Points: Define where to enter and exit trades, including stop-loss limits.

- Review Exposure: Ensure position sizes align with your risk appetite and account size.

- Reassess Frequently: Monitor market developments throughout the day to adjust as needed.

Conclusion: Your Roadmap to Better Bitcoin Price Decisions Today

Predicting Bitcoin’s price is never an exact science—especially on a daily basis. However, by combining technical analysis, sentiment tracking, and macro awareness, you can create a process for making data-driven decisions. Today’s bitcoin price prediction requires discipline, the right tools, and a willingness to adapt. Embrace measurable strategies, stay vigilant for new volatility triggers, and always protect your capital with clear risk controls. Your edge in the market comes not from guessing but from systematic, evidence-based action tailored to the fast-moving world of Bitcoin.

“`

Leave a comment