For anyone considering a stake in the fast-moving world of cryptocurrencies, deciphering the future of meme coins like Shiba Inu (SHIB) can feel both thrilling and overwhelming. The search for a trustworthy Shiba Inu coin price prediction reflects a real investor dilemma: the desire to find clarity amid volatility and hype. As speculative assets, meme coins tempt with tales of overnight riches but challenge even the seasoned with wild price swings. In this article, you’ll find a professional yet accessible guide to understanding Shiba Inu coin price prediction, the frameworks behind common forecasts, and the pitfalls to avoid—so you can make smarter, evidence-based choices on your crypto journey.

What Shiba Inu Coin Price Prediction Means in Today’s Crypto Market

The phrase “Shiba Inu coin price prediction” refers to analytical efforts—using data, trends, and market sentiment—to estimate the possible future value of Shiba Inu (SHIB). Originating as a so-called “Dogecoin-killer,” SHIB draws attention for its volatile price action, passionate online community, and ambitious roadmap spanning decentralized finance (DeFi) and NFTs.

Price predictions range from chart-based technical analysis to narratives driven by social media trends. For the typical retail investor, these predictions can be both alluring and dangerous: they may highlight opportunities but often underestimate risks and ignore underlying fundamentals. Context matters; a price forecast is not a guarantee but rather a scenario—especially for assets with limited utility or transparency.

Why It Matters for Prospective Investors

Volatility creates opportunity, but also risk. For someone interested in profiting from shiba inu coin’s price movement, understanding predictions isn’t just a speculative exercise—it’s central to managing risk, setting realistic expectations, and making informed, disciplined decisions. Sound analysis helps filter noisy speculation and provides guardrails against emotional or impulsive trading. Informed investors are less likely to fall for pump-and-dump schemes and more likely to deploy capital where outcome potential aligns with risk tolerance.

Core Framework for Making Sense of Shiba Inu Coin Price Predictions

A sensible approach to forecasting Shiba Inu price combines rigorous data analysis, market awareness, and skepticism. Below are the key pillars to guide your evaluation:

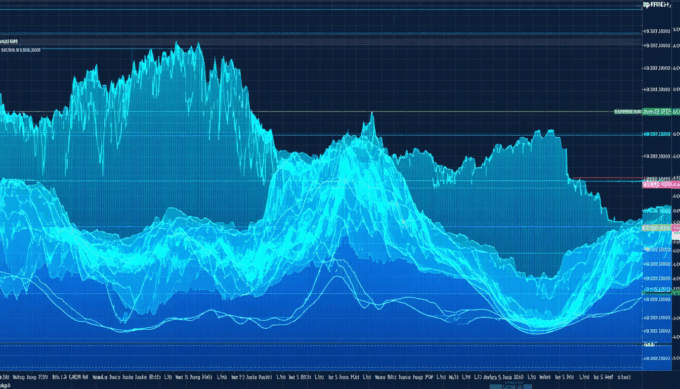

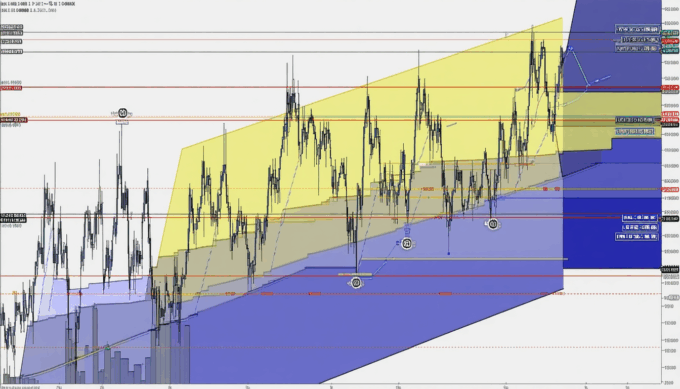

1. Technical Analysis: Reading SHIB’s Charts

Technical analysis interprets price action using indicators like moving averages, Relative Strength Index (RSI), support and resistance levels, and candlestick patterns. For SHIB, look at:

- Historical Price Trends: Identifying past spikes and corrections

- Trading Volume: Higher volume can validate price moves

- Key Levels: Noting where SHIB has repeatedly bounced or fallen

This approach won’t guarantee certainty but gives structure to judgments about when momentum may shift.

2. Fundamental Factors: Supply, Demand, and Ecosystem Growth

Fundamental analysis considers what drives value beyond the chart:

- Token Supply: SHIB started with one quadrillion tokens, but over 40% have been burned or removed (Etherscan, 2024)

- Developments: New technical features, partnerships, and ecosystem growth

- Community Sentiment: Online engagement and developer activity

Assessing these fundamentals can reveal whether a price surge is sustainable or likely to fade.

3. Market Sentiment: Social Media and Broader Crypto Trends

SHIB’s price is heavily influenced by sentiment—Twitter trends, Reddit threads, and mainstream headlines can trigger surges or slumps. Consider using social sentiment tracking tools to gauge prevailing moods, but always weight them against concrete data.

4. Managing Risk: Setting Targets and Stop-losses

Given SHIB’s volatility, prudent risk management is non-negotiable. Decide your entry and exit points in advance, and use stop-loss orders to cap potential losses. Investing only what you can afford to lose helps avoid emotional trading decisions.

5. Monitoring Tools and Metrics

Key resources include:

- Price trackers (e.g., CoinMarketCap, CoinGecko)

- On-chain analytics (e.g., Etherscan for supply/burn rates)

- Social sentiment analyzers

- Charting software for technical indicators

Consistent use of these tools fosters objective, rules-based analysis.

Data & Proof: What the Numbers Reveal

Notable SHIB Statistics

- As of 2024, Shiba Inu boasts over 1.3 million wallet holders—a sign of strong, growing adoption (CoinMarketCap, 2024).

- Despite its meme status, SHIB saw a 90%+ price increase during several weeks in early 2023, fueled by ecosystem news and renewed investor interest (Yahoo Finance, 2023).

- Over 400 trillion SHIB tokens have been burned since launch, reducing circulating supply and supporting price dynamics (Etherscan, 2024).

- The ShibaSwap decentralized exchange has processed over $1 billion in cumulative volume, enhancing SHIB’s utility beyond speculation (DefiLlama, 2024).

What This Means for Investors

These numbers suggest that, unlike some one-hit-wonder coins, Shiba Inu has managed to build a robust user base and ecosystem, offering staying power beyond viral moments. However, its price remains tied to broader sentiment and crypto trends. Token burning and ecosystem developments are positive, but investors should temper optimism with realism—meme coins still exhibit higher risk and unpredictability than established cryptocurrencies.

Practical Examples: Market Scenarios

Example A: Riding a Bullish Wave

Consider the October 2021 rally, when SHIB surged more than 1,000% in a month. Early buyers who spotted technical breakouts and rode social media momentum saw massive gains—provided they sold before the retracement. Successful navigation involved monitoring chart signals, setting realistic targets, and not overexposing to a single narrative.

Example B: The Dangers of FOMO

Contrast that with spring 2022, when new buyers, lured by media buzz, bought as SHIB peaked—then endured a swift 80% price drop as the hype faded. Here, reliance on unverified rumors and emotional decisions resulted in steep losses. The lesson: avoid entering trades based solely on social excitement and always use risk controls.

Common Mistakes & How to Avoid Them

- Chasing Hype: Buying in during viral FOMO can result in buying tops and suffering losses.

- Ignoring Fundamentals: Overlooking real project developments or excessive token supply risks missing structural weaknesses.

- No Exit Plan: Failing to predefine exit points often leads to holding through deep drawdowns.

- Overexposure: Allocating too large a portfolio share to SHIB magnifies volatility’s impact.

To avoid these mistakes, combine technical and fundamental analysis, keep your position size in check, and anchor decisions in real data.

Implementation Checklist: Making Informed SHIB Price Predictions

- Study Historical SHIB Charts: Review past price movements and volatility patterns.

- Track Token Supply and Burn Events: Monitor changes via on-chain data.

- Evaluate Ecosystem Updates: Stay informed about new launches, partnerships, or tech features.

- Gauge Market Sentiment: Use social listening tools to understand community mood.

- Establish Clear Entry/Exit Targets: Set and stick to disciplined buying and selling points.

- Limit Portfolio Exposure: Only invest what you can afford to lose—protect your downside.

Conclusion: Key Takeaways and Next Steps

Understanding Shiba Inu coin price prediction requires balancing optimism about potential gains with a frank appraisal of volatility and risk. While technical indicators and ecosystem stats offer guidance, the speculative nature of SHIB means no forecast is infallible. By deploying structured analysis, setting clear boundaries, and keeping perspective, you can participate judiciously and maximize informed outcomes. For your next steps, review your investment goals, utilize solid data sources, and apply a disciplined, evidence-led approach to any SHIB trade. Remember: Preparation and caution outweigh hype, every time.

Leave a comment