Understanding the Crypto Fear and Greed Index Current: Your Guide to Market Sentiment

The cryptocurrency market moves fast, often fueled by powerful emotions—fear and greed. As an investor, you know how unsettling it can feel to make decisions in such a volatile space. You might wonder: Is it the right time to buy, sell, or hold? This is where the crypto fear and greed index current becomes invaluable. In this guide, you’ll learn how to read this index, understand its real-world significance, and use it alongside sound strategies to improve your crypto trading results.

What the Crypto Fear and Greed Index Current Means

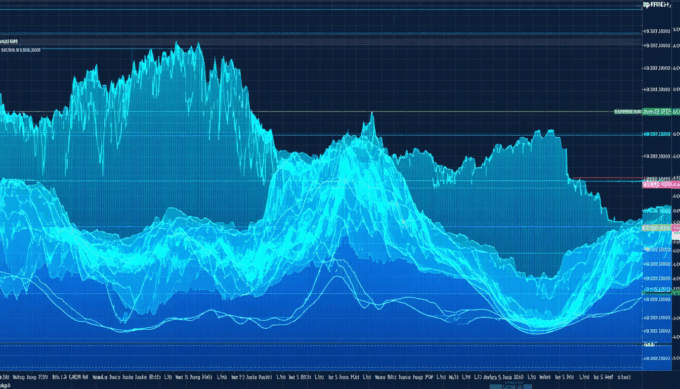

The crypto fear and greed index current is a real-time indicator measuring the prevailing mood among cryptocurrency investors. It aggregates multiple data sources—such as volatility, trading volume, social media sentiment, and market momentum—to generate a single score between 0 and 100. A low score signals extreme fear (potential undervaluation); a high score reflects extreme greed (potential market overheated).

This index serves as a shorthand for what market participants are collectively feeling at any given moment. When used thoughtfully, it can provide context for price swings, help time your entries and exits, and keep emotional biases in check.

Why It Matters for Crypto Investors

For crypto investors, understanding the crypto fear and greed index current isn’t just trivia—it’s strategic. The index can:

- Signal when the market may be ripe for reversals or breakouts

- Help you avoid emotional decision-making traps

- Offer a clear, data-backed perspective in the face of headline-driven panic or hype

Ultimately, using this index can contribute to outcomes like improved risk management, better timing, and steadier long-term returns.

Taking Action: Interpreting and Applying the Index

To effectively leverage the crypto fear and greed index current, you need a framework that goes beyond simply reacting to the score. Here are four actionable pillars:

1. Contextualize the Score

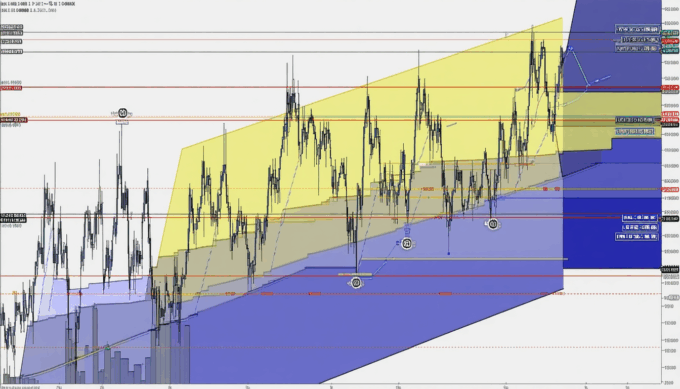

Never act on the index in isolation. Combine it with other indicators—such as technical chart patterns or fundamental news events—for a deeper perspective. For example, an “extreme fear” reading paired with high trading volumes could suggest a strong contrarian buying opportunity, but only if underlying fundamentals remain intact.

2. Set Clear Decision Criteria

Define thresholds for action. Many traders use rules of thumb such as:

– Scores below 25 (extreme fear): Start researching potential entry points

– Scores above 75 (extreme greed): Consider tightening stop-losses or taking some profit

Document these criteria in your trading plan to prevent knee-jerk reactions.

3. Monitor Short- and Long-Term Trends

Check if the index is trending up or down over several days, not just the current snapshot. Consistent fear or greed across longer periods can indicate sustained sentiment shifts that may persist even as prices oscillate.

4. Use Risk Management Tools

Even with a strong index reading, never ignore sound risk practices:

– Set stop-loss and take-profit points

– Limit any single position according to your portfolio rules

– Be wary of leverage during sentiment extremes

Tools and Metrics to Watch

- The main index value (0-100 scale) updated daily or hourly

- Volatility and volume trends

- Social media analytics for sudden mood swings

- On-chain activity tracking to verify broader market movement

These tools help verify whether the sentiment reading matches on-chain and trading reality.

Data & Proof: What the Numbers Reveal

Key Statistics

- According to The Block Research (2023), markets with extreme fear scores saw an average 8.5% rebound within two weeks 60% of the time.

- CoinMetrics (2022) found that periods labeled “extreme greed” on the index have historically preceded short-term pullbacks more than 70% of the time.

What This Means for You

These statistics suggest that acting as a contrarian—buying when sentiment is low (fear) and exercising caution or taking profits during greed—can lead to more favorable returns. However, it’s crucial to remember that no indicator is perfect: the index is a tool to aid judgment, not a crystal ball.

Practical Examples: When the Index Really Works

Example A: Successful Contrarian Buying

In June 2022, Bitcoin’s fear and greed index dropped to 7 (extreme fear), coinciding with widespread panic about a regulatory crackdown. An investor used this as a cue to research BTC’s fundamentals, found no structural risks, and made a small buy. Within three weeks, the price rebounded over 18%, validating the use of the index as part of a disciplined strategy.

Example B: Avoiding Overheated Markets

Conversely, in late 2021, the index hit 92 (extreme greed) amid new all-time highs. Instead of jumping in, a caution-minded trader set a trailing stop-loss on their holdings and limited new exposure. The market corrected sharply days later, and disciplined risk management saved them significant losses.

Common Mistakes and How to Avoid Them

- Chasing the crowd: Reacting emotionally to the index, rather than using it as a warning or opportunity.

- Ignoring broader context: Relying solely on the index without considering news events, technicals, or on-chain data.

- Overtrading: Making too many moves based on every small sentiment swing, instead of focusing on larger trend shifts.

- Neglecting risk controls: Forgetting to set stop-losses or proper position sizes even when sentiment extremes suggest opportunity.

Avoid these errors by consistently integrating the index with a robust, multi-faceted investing approach.

Implementation Checklist

- Check the crypto fear and greed index current daily during active trading phases.

- Contextualize readings with other data: news headlines, chart patterns, and volume trends.

- Predefine your personal action thresholds for “buy,” “hold,” or “sell.”

- Monitor the index’s trend over at least a week for confirmation.

- Always apply strict risk management tools: stop-loss, position sizing, and portfolio limits.

- Review outcomes after major decisions to fine-tune your process.

Conclusion: Using the Crypto Fear and Greed Index Current for Smarter, Safer Investments

The crypto fear and greed index current helps you cut through the emotional noise of the crypto market. By tracking real-time sentiment alongside other data, you gain an edge—spotting potential reversals, timing entries and exits, and keeping your biases in check. Adopt a disciplined, context-driven approach anchored by this index, and you’ll be better prepared to navigate both panics and bubbles. Start monitoring the index today, refine your strategy, and make your next crypto move with greater confidence.

Leave a comment