Introduction: Understanding the Price of XRP

The volatility and unpredictability of cryptocurrency markets can leave investors, traders, and curious observers constantly searching for updated answers to “What is the price of XRP?” Whether you’re planning to buy, trade, or simply monitor this digital asset, understanding what drives XRP’s price—and how to interpret it—matters greatly. In this comprehensive guide, you’ll learn not just how to find the current price, but also what factors shape XRP’s value, reliable ways to track price changes, and how to make well-informed decisions in the fast-evolving crypto landscape.

What the Price of XRP Means: Definition, Scope, and Relevance

Like other cryptocurrencies, XRP’s price represents its current value in the open market, most commonly quoted in US dollars. However, price discovery for XRP is not fixed to a central exchange or authority; instead, it is shaped by ongoing trades across numerous global platforms. Factors such as supply and demand, regulation, adoption trends, and even sentiment on social platforms can influence fluctuations.

Why the Price of XRP Matters for Investors and Enthusiasts

For anyone holding XRP or considering investing, knowing its price at any moment is directly tied to potential profits or losses. Traders rely on real-time pricing data to spot trends, execute buy/sell orders, or set alerts for certain thresholds. Long-term investors might interpret sustained price changes as signals of broader industry or project developments, such as regulatory news or major partnerships.

Core Framework for Understanding and Tracking XRP Pricing

Getting a grip on “what is the price of XRP” means more than glancing at a number. An informed approach requires understanding key dynamics, knowing how to interpret data, and using reliable tools.

Pillar 1: How XRP’s Price is Determined

Unlike stocks, XRP is traded around the clock on hundreds of exchanges worldwide. Price is set by a balance of buy/sell orders for every transaction. Higher trading volumes tend to stabilize price, while sudden spikes in activity can create rapid changes.

Pillar 2: Major Drivers Impacting XRP’s Value

- Market Sentiment: Positive news such as favorable court rulings or new financial partnerships can lift prices due to increased buying.

- Regulatory Developments: Announcements from agencies such as the US SEC have historically had swift impacts on XRP’s price, either rallying or depressing it.

- Overall Crypto Trends: XRP often follows broader uptrends or downturns seen in cryptocurrencies like Bitcoin or Ethereum.

Pillar 3: How to Check the Price of XRP

To get the most accurate current price, use reputable crypto price aggregators or exchanges. Look for platforms that display volume-weighted average price (VWAP) or prices from multiple sources for a more reliable snapshot. Monitoring prices across different exchanges, particularly during high volatility, can ensure accuracy.

Pillar 4: Tools and Metrics to Monitor

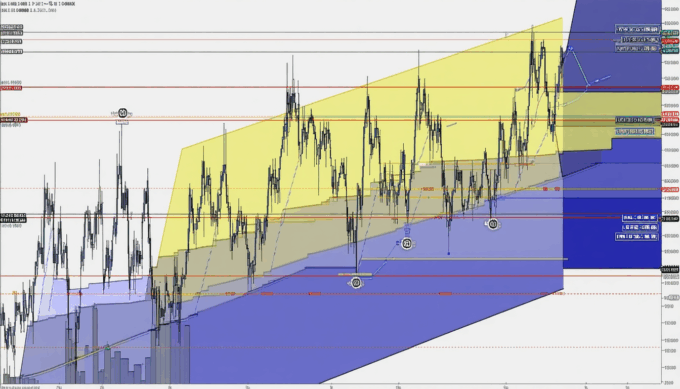

- Price Aggregators: Websites and apps that combine prices from various exchanges (e.g., CoinMarketCap, CoinGecko).

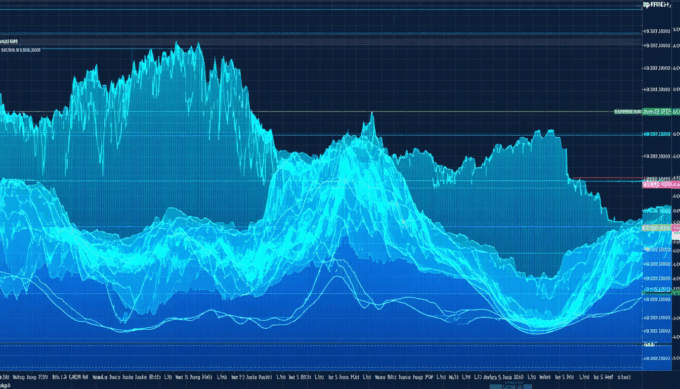

- Candlestick Charts: Visual tools to spot trends, resistances, and supports over time.

- Volume and Order Book Depth: Gauges of market strength that can predict near-term price movement.

Data and Proof: What the Numbers Tell Us

Key XRP Price Statistics

- As of April 2024, the average daily trading volume of XRP exceeds $1.5 billion, making it consistently one of the top 10 most-traded cryptocurrencies by volume (CoinGecko, 2024).

- XRP’s price has ranged broadly, hitting highs above $3.80 in January 2018, but more recently fluctuating between $0.50 and $0.75 through late 2023 and early 2024 (CryptoCompare, 2024).

What These Numbers Mean for Crypto Enthusiasts

Such sustained trading volume signals enduring interest and liquidity, making it relatively easy to buy or sell XRP compared to lesser-known coins. The significant price swings, however, remind investors that XRP’s value remains highly sensitive to news, regulation, and larger market movements.

Practical Examples: Tracking the Price of XRP

Example A: Using a Dedicated Price App

Samantha, a retail crypto investor, installs a popular price-tracking app on her smartphone. By setting price alerts for XRP, she is notified whenever the price drops below $0.60 or rises above $0.80. This allows her to act quickly, selling some XRP for profit during a price rally.

Example B: Watching Multiple Exchanges

David, a more advanced trader, observes that during periods of market stress, XRP’s price can differ slightly across exchanges due to varying liquidity. By tracking these differences with specialized software, he strategically buys XRP where it’s slightly cheaper and sells where it fetches a marginal premium, netting consistent profits.

Common Mistakes and How to Avoid Them

One common myth is that there’s a single, “official” price for XRP; in reality, it varies slightly between exchanges due to supply, demand, and local liquidity. Another error is relying solely on old or single-source data, which risks acting on outdated information. Some users overlook the impact of sudden news events, which can drive short-term volatility and trigger stop-losses. To avoid losses, always use multiple information sources, set reasonable price alerts, and consider the broader context before making rapid moves.

Implementation Checklist: How to Track, Analyze, and Act on XRP Price

- Choose Reliable Data Sources: Always verify XRP prices across two or more major aggregators or direct from exchanges.

- Set Price Alerts: Use apps or exchange features to notify you when XRP reaches critical buy/sell levels.

- Monitor Market News: Stay informed about major XRP updates or regulatory changes that could affect price direction.

- Use Charts: Regularly review candlestick charts and trading volumes for trend spotting.

- Review Your Strategy: Periodically assess your holdings and strategy based on evolving price patterns and personal risk tolerance.

Conclusion: Making Smarter Decisions Around the Price of XRP

In summary, knowing what is the price of XRP—and understanding what affects it—empowers investors and crypto enthusiasts to make more informed, confident decisions. By combining real-time price monitoring, context from market data, and practical tools, you reduce risk while maximizing potential gains. For best results, always double-check sources, remain alert to breaking news, and adapt strategies as conditions change. Start by tracking XRP’s price today using a trusted aggregator and set alerts tailored to your investment goals.

FAQs

How often does the price of XRP change?

XRP’s price can change every second as trades occur on global exchanges. For accurate and timely information, always check a real-time aggregator or active exchange.

Why do XRP prices differ between exchanges?

Different exchanges have varying liquidity and trading volumes, causing small differences in XRP’s price. Always compare several platforms before executing large trades.

What’s the best way to track XRP price automatically?

Use reputable cryptocurrency price-tracking apps or tools with customizable alerts. Set thresholds based on your goals so you’re notified of important price movements.

Does XRP’s price depend on Bitcoin?

While XRP’s price can follow broader crypto trends, it also reacts to XRP-specific developments such as regulatory news or partnerships. Don’t rely solely on Bitcoin’s movements for XRP predictions.

Can news or court decisions affect the price of XRP?

Yes—major news, especially regarding lawsuits or regulations, can cause sudden jumps or drops in XRP value. Staying updated enables timely decision-making.

Leave a comment