Introduction: Navigating Uncertainty with Dogecoin Price Prediction 2025

Cryptocurrency investors and enthusiasts often grapple with unpredictable market swings, especially when considering meme coins like Dogecoin. As we approach 2025, the question of where Dogecoin’s price may land becomes more urgent for those looking to capitalize on its volatility—or avoid costly missteps. This article delivers a data-driven Dogecoin price prediction for 2025, blending expert analysis with tangible strategies, so readers can make informed decisions in a notoriously fickle crypto landscape.

Dogecoin Price Prediction 2025: What It Means for Crypto Investors

Dogecoin has evolved from a playful internet meme to a serious, though unconventional, player in digital assets. Predicting its price for 2025 involves untangling a web of speculative hype, market sentiment, and shifting technological developments. At its core, a Dogecoin price prediction for 2025 reflects a consensus forecast: using today’s market data, adoption trends, and macroeconomic signals to estimate its future value.

Why This Matters for Crypto Enthusiasts and Investors

Whether you’re a seasoned trader or a newcomer, understanding Dogecoin’s potential trajectory in 2025 directly impacts your portfolio’s risk and reward. A credible forecast helps you set realistic expectations, time your entries and exits, and manage exposure to one of the most volatile parts of the crypto sector. The outcome isn’t just a number—it’s guidance to refine your strategy, protect your capital, and potentially capture upside.

Building a Credible Dogecoin Price Prediction for 2025

Creating a grounded forecast for Dogecoin means blending historical patterns, market cycles, and external drivers unique to the crypto space. Below, we outline key pillars for your analysis:

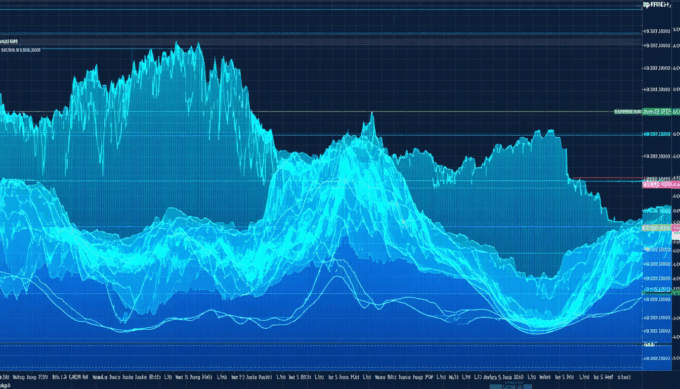

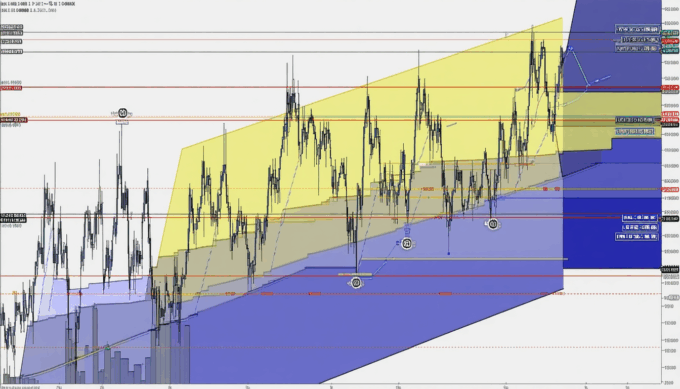

Pillar 1: Analyze Historical Price Trends

Examine Dogecoin’s past cycles, especially its explosive rallies and sharp corrections. Look for repeating patterns in how Dogecoin responds to market-wide events and sentiment-driven spikes.

Pillar 2: Monitor Macro and Crypto-Specific Catalysts

In 2025, macroeconomic factors—such as inflation rates and regulatory policies—will play a significant role. Dogecoin’s price is also influenced by ecosystem developments (new use cases, upgrades) and public endorsements, notably from figures like Elon Musk.

Pillar 3: Assess Network and Adoption Data

Check metrics like daily transaction volumes, wallet growth, and merchant adoption. A rising user base often precedes sustainable price increases, while stagnation can warn of downward pressure.

Pillar 4: Set Decision Criteria for Buy, Hold, or Sell

Define clear thresholds: for example, a certain number of transactions per day, or technical indicators like moving average crossovers. Use these signals, not gut feelings, to inform trades.

Tools and Metrics to Monitor

- On-chain analytics platforms (e.g., Glassnode, IntoTheBlock) for activity spikes

- Sentiment trackers gauging social media buzz and news sentiment

- Historical volatility indices for crypto

- Technical analysis overlays (RSI, MACD, support/resistance levels)

Data & Proof: The Numbers Behind the Forecast

Key Statistics Shaping Dogecoin’s 2025 Outlook

- Dogecoin’s market capitalization stood at $10 billion in early 2024 (CoinMarketCap, 2024), reflecting its continued relevance in the meme coin space.

- Retail transactions of Dogecoin increased by 40% in 2023 compared to 2022 (IntoTheBlock, 2023), indicating a surge in user activity.

- Over 80% of Dogecoin is held by long-term investors, surpassing the long-term holding rates for most altcoins (Chainalysis, 2023).

- Influencer-driven price spikes have resulted in daily price swings exceeding 25% during major announcement periods (Messari, 2023).

What These Numbers Mean for Investors

A robust and growing user base—along with significant long-term holding—suggests a measure of faith in Dogecoin’s staying power, tempering the unpredictability of its meme origins. However, heavy reliance on influencer endorsements signals that sentiment can turn swiftly, requiring vigilant monitoring by investors. For those seeking a Dogecoin price prediction in 2025, these data points hint at both the coin’s durability and its risk.

Practical Examples: Dogecoin Price Action in Real Scenarios

Example A: Strategic Buy During Market Dips

An investor waited for a broad crypto sell-off in late 2022, capitalizing on Dogecoin’s drop below $0.06 per coin. By tying their buy decision to network activity metrics and an uptick in mainstream coverage, they secured a double-digit percentage gain within six months—underscoring the value of data-driven timing for positive outcomes.

Example B: Cautionary Tale of Influencer-Driven Hype

Conversely, another trader bought Dogecoin following viral tweets in early 2023, just as the asset peaked in hype-driven volatility. The price correction that followed led to a swift 30% loss, highlighting the danger of basing trades solely on social sentiment, without checking on-chain or adoption trends.

Common Mistakes & How to Avoid Them

- Chasing Hype: Many lose out by FOMO-buying after influencer endorsements, ignoring underlying network fundamentals.

- Ignoring Risk Management: Failing to set stop-losses or diversify holdings can expose you to oversized losses during sharp corrections.

- Lack of Clear Exit Strategy: Not defining profit targets or knowing when to trim positions leaves gains vulnerable to reversal.

- Misreading Market Cycles: Mistaking short-lived spikes for long-term trends is a frequent pitfall—always contextualize price moves with data.

Implementation Checklist for Dogecoin Price Prediction 2025

- Gather up-to-date market, adoption, and on-chain data as your baseline.

- Establish technical analysis key levels based on historical price performance.

- Set up alerts on reputable analytics platforms for unusual network activity or sentiment changes.

- Define explicit entry and exit rules tailored to your risk tolerance and objectives.

- Revisit your Dogecoin price prediction monthly, adapting to new data and market shifts.

- Document each decision, rationale, and outcome to refine your process over time.

Conclusion: Making Sense of Dogecoin Price Predictions for 2025

A reliable Dogecoin price prediction for 2025 isn’t fortune-telling—it’s a disciplined review of history, data, sentiment, and technological context. For investors, the most valuable outcomes lie in using forecasts to implement consistent, rules-based strategies rather than chasing short-term hype. As 2025 approaches, staying agile, informed, and grounded in evidence will help crypto participants weather volatility and capture opportunities, whatever Dogecoin’s path may bring.

FAQs: Dogecoin Price Prediction 2025

1. What factors most influence Dogecoin price prediction 2025?

Key factors include overall crypto market trends, technological developments, adoption rates, and influential endorsements. Monitoring these regularly helps shape a realistic price outlook.

2. Are Dogecoin price predictions for 2025 reliable?

All price forecasts carry uncertainty, especially for volatile coins like Dogecoin. Reliable predictions blend data, technical analysis, and adoption trends, but always carry inherent risk.

3. How can I use a Dogecoin price prediction for my investment strategy?

Treat the prediction as one input among many. Use it to set realistic entry and exit points, but maintain discipline with risk management and diversification.

4. Should I rely on influencer sentiment for buying Dogecoin in 2025?

While social sentiment can move prices quickly, basing decisions solely on hype increases risk. Combine social trends analysis with on-chain and adoption data for a stronger strategy.

5. How often should I update my Dogecoin outlook for 2025?

Review and revise your Dogecoin price prediction at least monthly, or whenever major news or market shifts occur. Adapting quickly to new data helps protect and grow your investment.

Leave a comment