Introduction: The Stakes of Bitcoin Price Forecast 2025

For investors, traders, and crypto enthusiasts alike, understanding the bitcoin price forecast for 2025 isn’t just academic curiosity—it’s a crucial element of strategic decision-making. With bitcoin’s notorious volatility, wild historical swings, and growing mainstream attention, the question of where its price might land in coming years is more pressing than ever. This article will break down reputable forecasts, key driving factors, and expert insights to help you approach bitcoin investments in 2025 with clear expectations and a grounded strategy.

What a Bitcoin Price Forecast 2025 Means Today

A bitcoin price forecast for 2025 involves analytical projections of where Bitcoin’s valuation might head, factoring in historical trends, macroeconomic signals, technological adoption, market sentiment, and regulatory developments. Unlike traditional stock forecasts, bitcoin projections are shaped by both global events and the unique properties of decentralized cryptocurrencies.

Why This Forecast Matters for Investors and Traders

Whether you’re a long-term holder, an active trader, or just starting in crypto, a reliable bitcoin price forecast for 2025 enables you to plan portfolio moves, set risk parameters, and capitalize on emerging opportunities. Informed forecasting connects to tangible outcomes: smarter entries and exits, more resilient portfolios, and a clearer understanding of both upside and potential losses.

Core Strategies for Interpreting Bitcoin Price Forecasts

Reliable predictions combine multiple analytic pillars. Here’s a strategic breakdown to guide your assessment:

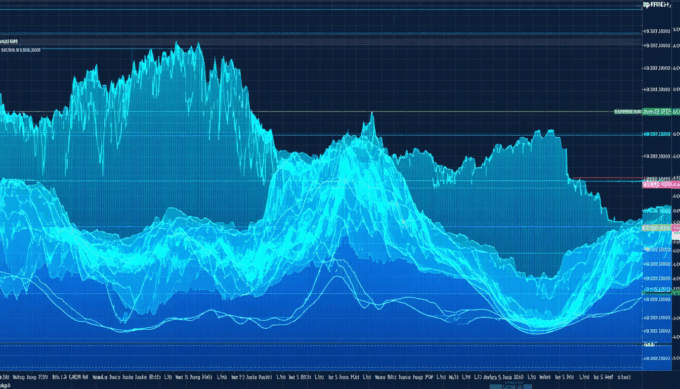

1. Analyze Historical Price Cycles

Bitcoin’s history shows cyclical patterns closely tied to its halving events—the periodic reduction in mining rewards. Reviewing how prices reacted following each halving can reveal recurring trends and support more data-driven forecasts.

2. Monitor Regulatory and Policy Moves

Watch for regulatory clarity or major government actions, as these can swing market sentiment. Regulatory acceptance may lead to institutional inflows, while crackdowns tend to spark pullbacks. Given bitcoin’s borderless nature, global policies—from the U.S. SEC or Europe to Asia’s evolving stances—can ripple worldwide.

3. Assess Macro Trends and Institutional Adoption

Global inflation rates, central bank policies, and broader economic health directly affect risk assets like bitcoin. Meanwhile, rising participation among institutional investors—that is, hedge funds, banks, and asset managers—often reinforces or tempers price movement.

4. Track On-Chain Data and Supply Metrics

Metrics such as wallet growth, active addresses, mining activity, and available supply on exchanges provide a transparent window into the bitcoin network’s health and momentum.

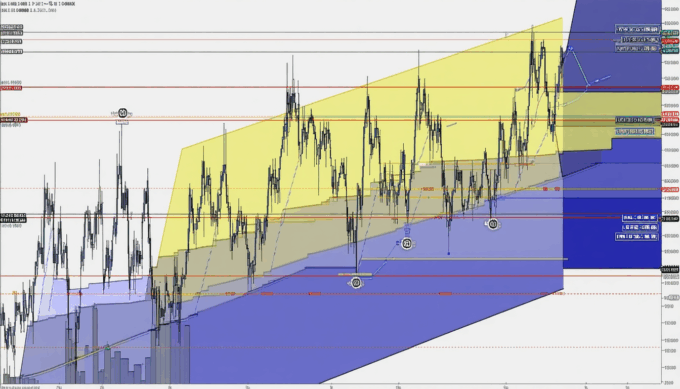

5. Use Technical Analysis and Price Models

From moving averages to advanced stock-to-flow (S2F) models, technical tools help plot potential support, resistance, and price targets. While no single model is infallible, these tools offer structure amidst market chaos.

Metrics and Tools to Keep in Focus

- Price charts with volume overlays

- On-chain analytics dashboards

- Economic calendar (for macro events)

- Sentiment analysis from institutional reports

- Historical volatility and risk metrics

Data & Proof

Key Statistics Shaping the Bitcoin Price Forecast for 2025

- As of late 2023, bitcoin’s market capitalization hovered around $900 billion, with institutional ownership making up approximately 10% of total supply (Glassnode, 2023).

- Historical post-halving cycles have led to price increases of 300-500% within 12-18 months after each halving event (CoinMetrics, 2022).

What These Numbers Mean for Investors

Rising institutional involvement suggests growing mainstream acceptance and price stability. Past cycles hint at significant upside potential in the years following halving events. However, historical patterns are not guarantees—macroeconomic factors and regulation remain significant variables that can alter outcomes for the 2025 bitcoin price forecast.

Practical Examples: Forecast Insights in Action

Example A: Forecast-Driven Investment

A mid-sized asset manager analyses bitcoin’s previous post-halving rallies, along with positive signals from recent ETF approvals and steady growth in global adoption. Based on this, they allocate 5% of their portfolio to bitcoin in 2024, aiming to hold through potential 2025 gains. By monitoring news flow and adjusting for economic cycles, they achieve a well-timed entry, setting clear take-profit levels.

Example B: A Contrasting Scenario

An individual retail investor chases short-term price spikes driven by social media hype in early 2025, ignoring macro and regulatory warnings. The investor enters at a local peak just as global regulators announce stricter compliance measures, leading to a sharp pullback. This scenario underscores the risks of relying solely on sentiment rather than evidence-based forecasting.

Common Mistakes and How to Avoid Them

- Overreliance on Single Models: No forecast is foolproof; diversify your information sources and analytical approaches.

- Ignoring Regulatory Risks: Changes in crypto legislation can trigger dramatic price swings.

- FOMO and Confirmation Bias: Reacting emotionally to news or only seeking information that fits preconceptions can lead to costly misjudgments.

- Neglecting Security: Regardless of forecast, poor custody practices or falling for unregulated exchanges can result in losses independent of market movements.

Implementation Checklist

- Define your investment time horizon—are you aiming for short-term trades or long-term holding into 2025?

- Research multiple bitcoin price forecasts from credible sources, including both bullish and conservative viewpoints.

- Regularly monitor macroeconomic indicators, regulatory changes, and on-chain analytics.

- Establish clear entry, exit, and risk management protocols tied to your forecast-informed thesis.

- Continuously review and adjust your plan as new data emerges and market conditions shift.

Conclusion: Bitcoin Price Forecast 2025—Where Next?

Navigating the bitcoin price forecast for 2025 demands an informed, disciplined approach. By leveraging historical data, regulatory analysis, and real-time adoption trends, investors can position themselves for both opportunity and risk management. While forecasts offer valuable guidance, active engagement and ongoing research remain essential. As you prepare for 2025, blend analytical rigor with adaptable strategies to maximize potential rewards while safeguarding against the unpredictable nature of the bitcoin market.

FAQs

How reliable are bitcoin price forecasts for 2025?

Forecasts offer informed scenarios based on current data and trends, but the inherent volatility of bitcoin and shifting global factors mean all predictions should be considered with caution and as part of a diversified plan.

What are the biggest risks to the bitcoin price forecast in 2025?

Regulatory changes, major technological shifts, and unforeseen macroeconomic events can delay or accelerate price movements, impacting even the best-laid forecasts.

Is it too late to invest in bitcoin before 2025?

Many experts believe that bitcoin’s growth potential remains, especially as adoption expands. However, entering with clear objectives and risk management strategies based on up-to-date forecasts is key.

How should I use a bitcoin price forecast for 2025 in my investment plan?

Treat forecasts as one input among many—combine them with technical analysis, macro data, and your personal risk profile before making decisions.

What metrics are most important for analyzing the 2025 bitcoin price forecast?

Track market capitalization, institutional investment levels, adoption rates, halving cycles, and on-chain network data to stay informed about long-term trends influencing bitcoin’s price.

Leave a comment