If you’ve been tracking the crypto markets, you’ve probably asked yourself: why is XRP dropping despite Ripple’s ongoing developments and high-profile partnerships? It’s a frustrating experience—watching your investment dip without a clear explanation can shake even seasoned traders’ confidence. This article provides clarity, examining not just recent price declines in XRP but also the core drivers (regulatory, macro, and technical) shaping Ripple’s trajectory. By the end, you’ll understand why XRP has fallen, how to spot warning signs in the future, and where opportunity or caution may lie for holders and traders.

What “Why Is XRP Dropping” Means for Crypto Investors

XRP’s price movements don’t happen in a vacuum. When people search “why is XRP dropping,” they’re seeking insight into the ripple effects (no pun intended) of market sentiment, legal battles, and broader industry trends. In 2023 and 2024, XRP faced unique pressures that distinguish it from other top cryptocurrencies—especially due to Ripple Labs’ legal tussles with U.S. regulators and shifting crypto market tides globally.

Why Understanding XRP’s Decline Matters for Investors

For crypto investors and active traders, these downtrends mean more than numbers on a chart. Understanding why XRP is dropping arms you to respond with informed decisions, whether reallocating assets, holding through volatility, or capitalizing on dips. It’s about managing risk while keeping sight of the market’s emotional cycles and objective signals.

Core Reasons Behind XRP’s Price Decline

XRP’s major price drops rarely trace back to a single catalyst. Instead, several recurring factors tend to converge, creating downward pressure on the token.

1. Regulatory Uncertainty and Legal Challenges

Ripple’s ongoing case with the U.S. Securities and Exchange Commission (SEC) remains the biggest single overhang for XRP. In 2023, the SEC’s partial victory—claiming certain sales of XRP violated securities laws—created a cloud of uncertainty. Even though there were some rulings in Ripple’s favor, the case continues to spark caution among institutional investors, with many U.S. exchanges delisting or restricting XRP trading to avoid regulatory heat.

2. Broader Crypto Market Sentiment

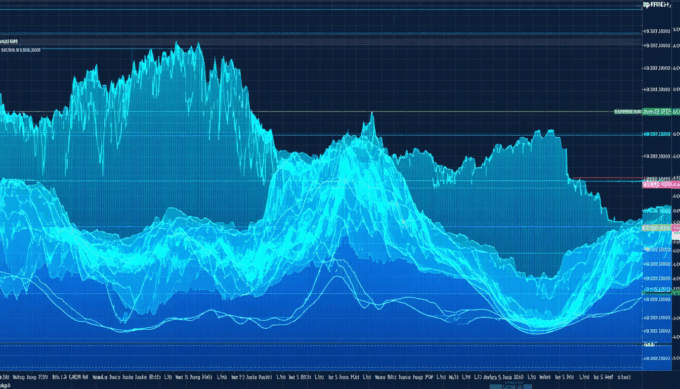

Macro-economic shocks—such as interest rate hikes, inflation fears, and the collapse of high-profile crypto firms—often drag the whole sector down. XRP tends to follow these broad moves, with Bitcoin’s performance especially influential. In June 2023, after a major selloff in Bitcoin and Ethereum, XRP tumbled by over 18% within weeks (CoinMarketCap, 2023). Negative sentiment in the broader market accelerates XRP’s losses, as investors rotate to perceived safer assets.

3. Technical Selling and Whale Activity

XRP, like many altcoins, is highly sensitive to large holders (“whales”) executing significant trades. When whales dump coins, it can trigger stop-losses, leading to cascading sell orders. In July 2023, on-chain data showed several major wallets moving millions of XRP to exchanges shortly before price dips (Santiment, 2023). High selling volume from influential accounts reinforces downward momentum.

4. Delayed Ecosystem Developments

Unlike competitors who consistently roll out major product or protocol upgrades, Ripple’s ecosystem growth sometimes lags behind market expectations. Announcements that fail to produce immediate adoption or excitement can trigger disappointment and selloffs among speculative traders.

5. Global Policy and Exchange Delistings

Around the world, regulatory news or exchange actions also play a role. For example, large Asian exchanges have occasionally restricted XRP trading in response to the SEC case, further shrinking liquidity and audience reach.

Tools, Checks, and Metrics to Monitor

- Volume spikes on major exchanges (can indicate panic selling or whale activity).

- Social sentiment indicators tracking keywords like “delist” or “SEC.”

- Regulatory news alerts—set up for the U.S. and major Asian jurisdictions.

- Cross-checking XRP’s correlation with Bitcoin and Ethereum price moves.

Data & Proof: What the Numbers Say

Key Market Stats

- In July 2023, XRP’s market cap plunged by over $6 billion in less than two weeks, correlating with regulatory filings and whale movements (CoinMarketCap, 2023).

- After the July 2023 U.S. SEC ruling, XRP’s trading volume on U.S. exchanges decreased by 40% within a month (CryptoCompare, 2023).

What the Numbers Mean for Investors

These numbers reflect how swiftly legal decisions and big trades can wipe out billions in value and narrow access for regular investors. When liquidity dries up or major players panic, prices can fall abruptly—often far faster than they recover.

Practical Examples of XRP Price Drops

Example A: SEC Lawsuit Triggers a Selloff

In December 2020, the SEC announced its lawsuit against Ripple, alleging that XRP is an unregistered security. Within days, XRP’s price dropped by more than 50%, as major U.S. exchanges like Coinbase announced plans to suspend trading. Short-term traders who reacted quickly were able to limit losses, while holders faced months of suppressed prices.

Example B: Contrast with a Market-Wide Correction

During the crypto-wide crash in mid-2022, even coins without regulatory headwinds dropped sharply. XRP fell about 35% alongside Bitcoin and Ethereum, demonstrating that broad market forces (like fears of recession or Fed policy) can impact prices just as profoundly as project-specific news.

Common Mistakes & How to Avoid Them

- Panic Selling: Reacting to headlines without verifying facts can lock in losses unnecessarily.

- Ignoring Broader Trends: Focusing solely on XRP-specific news disregards the influence of crypto-wide events.

- Overexposure: Allocating too much portfolio weight to one asset, especially one under regulatory scrutiny, amplifies risk.

- Neglecting On-Chain Data: Whale activity and exchange inflows are visible with basic blockchain tools—savvy investors monitor these for clues.

Implementation Checklist: Navigating XRP Downturns

- Stay updated on regulatory news, especially from the SEC or major global agencies.

- Track whale movements and notable wallet transfers using on-chain analytics tools.

- Monitor price correlation between XRP and major coins (BTC/ETH) to gauge macro sentiment.

- Watch for changes in trading volume and liquidity on your preferred exchanges.

- Reevaluate your risk exposure to XRP periodically—diversification is key.

- Don’t act impulsively: verify headlines, seek context, and use limit orders rather than market sells in volatile conditions.

Conclusion: Making Sense of Why XRP Is Dropping

In summary, understanding why XRP is dropping requires a holistic perspective—regulatory action, market sentiment, whale behavior, and global policy shifts all play a part. By following the data, scrutinizing news for substance, and monitoring on-chain signals, investors can avoid reactionary mistakes and make reasoned decisions. Going forward, staying vigilant to these factors and keeping a well-balanced crypto portfolio will help you navigate both the risks and opportunities presented by XRP and the wider digital asset space.

Stay informed, stay calm, and remember: markets move in cycles, but preparation gives you the edge.

Leave a comment