Introduction: Why Bitcoin Price Prediction 2025 Matters

You’re not alone in wondering where bitcoin might be headed by 2025. The crypto market’s wild swings, breakthrough innovations, and shifting regulations keep both investors and casual observers on edge. Whether you’re planning to invest, diversify your assets, or simply want to understand the future landscape, a reliable bitcoin price prediction for 2025 can shape financial strategies and highlight major risks or opportunities. This article offers a level-headed, thoroughly researched outlook to help you cut through hype and uncertainty to make smarter, more informed choices.

What Bitcoin Price Prediction 2025 Means for Investors

Projecting bitcoin’s price for 2025 involves more than fortune-telling—it’s a rigorous exercise in pattern recognition, economic analysis, and data-based forecasting. Predictions depend on a mesh of factors: historical trends, technical chart patterns, supply and demand mechanics, regulatory news, and adoption rates across the globe. For investors and anyone with a stake in digital assets, a robust prediction framework is invaluable for hedging risks and leveraging potential upswings.

Why This Matters for Individual Investors

A credible bitcoin price prediction 2025 can help investors decide when to buy, sell, or hold. Thoughtful analysis means fewer decisions based on emotions or market noise. For newcomers, it provides a structured entry point; for experienced holders, it offers an edge in timing and portfolio allocation. Above all, informed predictions reduce the chances of costly mistakes and help align risk tolerance with financial goals.

A Proven Framework for Bitcoin Price Prediction 2025

Forecasting bitcoin’s price three years out involves both art and science. Building a reliable framework centers on three actionable pillars: fundamental analysis, technical analysis, and sentiment or macro analysis.

Pillar 1: Fundamental Analysis

Start with supply-demand dynamics. By 2025, bitcoin’s fixed supply and the halving cycle (the most recent was in April 2024) will continue to tighten new coin issuance, creating historic upward price pressure. Scrutinize on-chain metrics like wallet growth, hash rate, and the percentage of coins held long-term. These data points signal increasing user adoption and network strength.

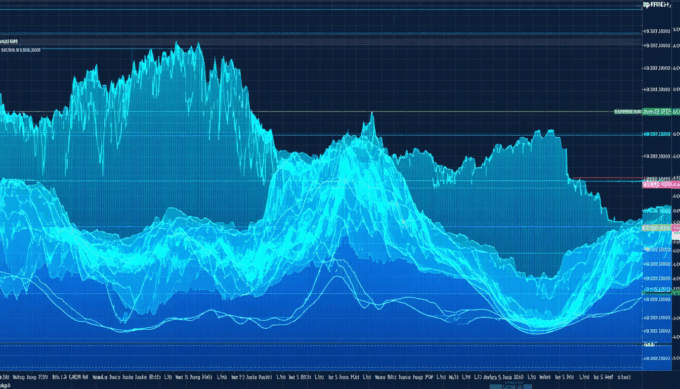

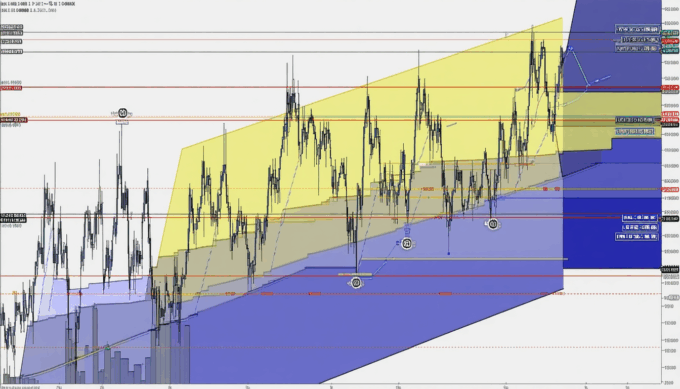

Pillar 2: Technical Analysis

Leverage daily, weekly, and monthly charts to identify major support/resistance levels, moving averages, and long-term trends. Price history reveals recurring cycles: for instance, post-halving rallies often drive new all-time highs within 12 to 18 months, hinting at a possible top in the 2025 time frame.

Pillar 3: Macro and Sentiment Analysis

Expand your lens beyond crypto. Monitor the Federal Reserve’s interest rate moves, inflation signals, and broader economic health. Regulatory announcements from the SEC or global authorities can either buoy or batter investor confidence. Social media sentiment analysis tools, such as The TIE or LunarCRUSH, capture real-time mood shifts that often precede major moves.

Tools, Checks, and Metrics to Monitor

- On-chain analytics platforms like Glassnode or CryptoQuant for wallet distribution and miner activity

- Standard technical indicators: Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Fibonacci retracement

- Google Trends and crypto Fear & Greed Index for sentiment benchmarking

Vigilant monitoring of these metrics sharpens your prediction accuracy and allows course corrections as new data emerges.

Data & Proof: What the Evidence Says

Key Statistics

- Bitcoin’s historical post-halving performance: After the 2020 halving, bitcoin surged from $8,700 in May 2020 to $64,000 in April 2021 (CoinMarketCap, 2021).

- Adoption trends: Over 106 million people worldwide own bitcoin, with global crypto adoption growing 880% year-over-year in 2021 (Chainalysis, 2021).

- Volatility index: Bitcoin’s price swung an average of 60% in annual volatility from 2015 to 2023 (Messari, 2023).

- Long-term holding: Over 65% of bitcoin’s circulating supply hasn’t moved in over a year, a bullish indicator for supply scarcity (Glassnode, 2023).

What These Numbers Mean for Investors

Steep post-halving rallies and record adoption point toward continued structural growth, but volatility will likely remain high. The prevalence of long-term holders suggests strong conviction and reduced sell pressure, potentially setting the stage for a bullish 2025—provided macro conditions don’t turn sharply negative. For investors, these trends validate a cautious-yet-optimistic stance but underline the need for risk management.

Practical Examples of Bitcoin Price Prediction in Action

Example A: The 2020–2021 Cycle

A retail investor who followed halving cycles and monitored on-chain metrics noticed wallet accumulation and tightening supply through mid-2020. By dollar-cost averaging into bitcoin post-halving, this investor participated in the bull run to $64,000, realizing gains of over 600% by April 2021. This shows disciplined framework-based investing can uncover major opportunities.

Example B: The 2022 Market Correction

Another case saw traders relying solely on social media hype and short-term technical patterns in late 2021. Amid euphoria, many ignored warning signs like declining new wallet activity and macro headwinds (e.g. rising interest rates). When the market reversed, these investors suffered large drawdowns. The lesson: comprehensive frameworks catch risks that isolated tactics miss.

Common Mistakes & How to Avoid Them

- Chasing hype: FOMO-driven buying after dramatic price spikes leads to buying tops and suffering sharp corrections.

- Ignoring fundamentals: Technical charts alone can be misleading without on-chain and macro context.

- Over-leveraging: Leveraged trades can multiply losses during sudden volatility, wiping out portfolios.

- Neglecting regulation: Dismissing new government policies can result in unexpected crashes or seizures.

To avoid these pitfalls, stick to a comprehensive, data-driven approach and set clear, level-headed entry and exit criteria.

Implementation Checklist

- Study bitcoin’s historical halving and adoption patterns to set a realistic baseline for 2025.

- Track key on-chain metrics such as wallet growth, mining activity, and long-term holding ratios.

- Use technical analysis to establish support/resistance levels and trend confirmation.

- Monitor macroeconomic indicators and major regulatory news; adjust strategies accordingly.

- Regularly review and rebalance your portfolio to match evolving risk tolerance and new data insights.

Conclusion: Synthesizing Expert Bitcoin Price Prediction 2025

Forecasting the bitcoin price for 2025 demands discipline, open-mindedness, and constant learning. Evidence from adoption rates, post-halving rallies, and the growing base of long-term holders all suggest potential for a strong upside in the next cycle, though volatility and external shocks remain ever-present risks. By applying a multifaceted analytical framework to your investment process, you’ll be better prepared to seize opportunities and sidestep hazards in this unpredictable market. Stay curious, stay informed, and revisit your strategy as new data unfolds.

FAQs

How reliable are bitcoin price predictions for 2025?

Most bitcoin price predictions 2025 use a mix of data and models, but there is always uncertainty due to market volatility and global factors. Use them as guides, not guarantees, and update your approach as new information arises.

What is the biggest risk to bitcoin’s price by 2025?

Regulatory crackdowns or global economic shocks could disrupt even the best bitcoin price prediction 2025 frameworks. Diversification and risk management are essential.

Which metrics should I watch to improve my own forecasts?

Focus on halving cycles, wallet growth, long-term holding rates, on-chain data, and broader economic trends as you track the market toward 2025.

Is 2025 a good year to invest in bitcoin?

Historically, post-halving years exhibit strong performance, but each cycle is unique. Base decisions on comprehensive research and personal risk tolerance, using tools from this article to guide your planning.

Should I only use technical analysis for price predictions?

Relying solely on technical analysis can miss larger macro and fundamental factors. Blend it with on-chain data and sentiment analysis for a balanced bitcoin price prediction 2025 strategy.

Leave a comment